The Father Of Value Investing Would Love These 5 High-Yielders

How much is a business worth? Answer that question competently, and you are miles ahead of most investors. Unfortunately, there is no easy definition or formula. Entire books have been devoted to this topic, most of which delve into some rather complex math.

But it’s worth learning some of the basics. After all, how can you know whether a stock is overpriced or underpriced without first estimating the value of the company?

| —Recommended Link— |

| You’ll Want to Grab These Buy Details ASAP While most companies have to start each day at $0 in sales… my favorite monthly payer generates daily profits rain or shine-and regardless of what’s going on in the economy. Plus…its revenue has risen more than 60% over the past four years. That’s why I’m urging you to grab this company right now. Don’t wait…Get the buy details here ASAP. |

The value of any asset (from a bond to a rental property) is a function of the cash flows it earns each year. So to value a business, I forecast future operating cash flows as precisely as possible and then discount them back into today’s dollars. This calculation can be quite technical, involving other variables such as interest rates, volatility and cost of capital.

#-ad_banner-#The more common approach is to simply assign a multiple to current earnings. The good old-fashioned price/earnings (P/E) ratio. Let’s suppose the average stock in the banking industry trades at 10 times earnings. So if one company in this group has reported $2.00 per share in profits over the past year, you could argue that the stock is worth $20 — a price of, say, $16 might be a bargain.

I say “might” because there are other factors we haven’t considered. For instance, this particular bank might deserve to trade at a discount to peers because it made too many bad loans that are now in default.

The most obvious limitation is that future growth prospects haven’t been incorporated. Two similar banks might both have the same earnings today, but the first is expected to grow profits 12% annually, while those at the second are forecast to shrink by 5% a year. You would reasonably expect company “A” to trade for more.

All things equal, stronger earnings growth deserves a richer valuation.

And there’s another deficiency of P/E. We haven’t yet evaluated any assets (or debt) held by the company. Could a retail stock with a P/E of 14 be a better buy than a rival at 16? Possibly. But what if the first company only owns $200 million worth of property and equipment, while the second owns $500 million?

The seemingly more expensive stock might be the better buy. Physical assets don’t show up on the income statement. But they can always be sold and are certainly an integral component of value.

That brings me to today’s topic. Let’s remove earnings from the picture for a moment (they are constantly changing and difficult to predict anyway) and focus strictly on company assets and liabilities. These totals are conveniently laid out on the balance sheet each quarter.

| —Recommended Link— |

| Put An Extra $23,000 In Your Pocket Every Year… There’s a simple investing system that regular investors are using to collect extra paychecks every month… totaling as much as $23,000 per year. It’s called The Dividend Trifecta, and they are telling us that this $23,000 number is the real thing. They don’t have special resources or connections… they just have The Dividend Trifecta… and 10 spare minutes a month to use it. Now it’s your turn: click here to learn how it works. |

If we take all the assets (things like cash, land and inventory) and then subtract all the outstanding liabilities (accounts payable, debt, etc.) we are left with book value or shareholder equity. Theoretically, in the event of liquidation, this is the residual value that stockholders could divvy up and split after everything has been sold and all the bills paid.

This is the tangible net worth of the business.

The deepest value stocks trade for less than their current book value. Take ArcelorMittal (NYSE: MT). The steelmaker has a book value of $39.85 per share. Yet, the stock can be purchased for $28.80. That’s a discount of 27% to the net value of what the business owns.

Most stocks on the S&P 500 ordinarily trade at 2 to 3 times their book value, a richer price that reflects not only their assets but also their earnings potential. But in the case of MT, the company can be bought for less than what it’s worth on paper right now — meaning its future earnings are essentially free.

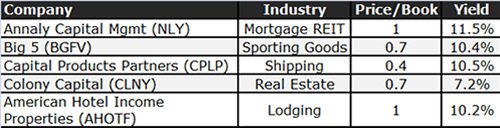

Ben Graham (Warren Buffett’s professor and mentor) used to love these kinds of stocks. For today’s screen, I have uncovered five value stocks with double-digit average yields and Price/Book of 1.0 or lower.

I find Price/Book to be a useful metric. But like any statistic, it has limitations and shouldn’t be used in isolation.

For one thing, book value might be rapidly falling (if a company is burning through cash, for example). Also, intangible assets (such as patents and intellectual property) are tough to properly pin a number on and might sometimes artificially inflate or deflate reported book value.

Yet, while imperfect, this little figure can help pinpoint underpriced stocks that have room to climb, especially when book value is rising. That just might be the case with sporting goods retailer Big Five (Nasdaq: BGFV). The company operates 435 stores in 11 states, selling everything from camping gear to snow skis.

Big Five has $473 million in assets and $293 million in liabilities, leaving net shareholders equity of $180 million. With 21 million shares outstanding, the company has a book value of $8.57 per share. Today, BGFV is selling for less than $6 per share.

Sales are a bit soft at the moment, slipping 2% last quarter to $240 million. But the third quarter is trending higher, and if the $0.15 quarterly dividend can be maintained, BGFV could deliver attractive total returns.

I’ve got BGFV (and the other stocks in this list) on my radar. But I’m not making them official recommendations to my premium High-Yield Investing readers just yet.

You’re welcome to do your own research on the stocks in this list, but as always, if I find a real gem within these screens, my High-Yield Investing subscribers will be the first to hear about it.

If you’d like to join us in our search for the best high yields the market has to offer, then I want to invite you to learn more about High-Yield Investing. You don’t have to settle for the paltry yields offered by most stocks. The high yields are still out there.

You just have to know where to look — and my staff and I are here to help you along. To start earning more income now, check out this report.

Editor’s Note: Missed The Extreme Tech Profits Summit? Watch The Rebroadcast!

We hope you had the chance to tune in to the Extreme Tech Profits summit last week. The event was chock-full of incredibly valuable (and actionable) information. Due to overwhelming demand for the summit, we’ve decided to rebroadcast the summit to those who missed out last Wednesday. The video is still available, but it won’t be up for long. Click here to watch it now.