5 Fast-Growing Small-Caps To Watch…

If there is a single trait that all game-changing stocks, regardless of their size or industry, share, it would be their outsized growth potential.

This comes with the territory. An innovative company can benefit from being a disruptor by grabbing market share from established competition, contributing to the creation of new markets or accelerating the development of existing ones. In every case, if it’s successful, its innovative nature translates into faster-than-average growth. As the company in question grows its profits, its stock price responds in kind, appreciating faster than its peers. An accelerated growth means accelerated share-price appreciation, all else equal.

This growth potential can be especially rewarding in the world of small-cap stocks. While the risks are higher — a smaller company can grow faster but it can also falter easier as it often lacks the kind of resources needed to break through competition barriers — the rewards can be significant.

This is why over at Game-Changing Stocks, we continue to emphasize growth companies. And this is why the stock screen I want to share with you today is about growth as well.

The Screen: Small-Cap Growth Stocks

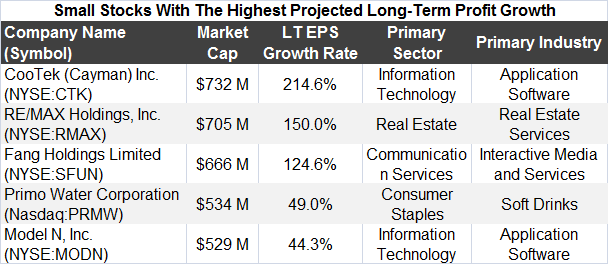

I searched for companies with market capitalization of $1 billion or less that are expected to grow their per-share profits the fastest. To do this, I looked at all small-sized companies listed on the major U.S. exchanges (NYSE and Nasdaq) in terms of their long-term profit expectations, and then reviewed the top 10% of these companies.

Out of the 17 stocks that the initial screen returned, I then weeded out all the companies with market capitalizations smaller than $500 million — companies that are too small are usually followed by too few analysts, so the quality of earnings projections on these companies is likely to be less reliable than that of their larger brethren. I am keeping those filtered-out companies on my watch list, but for now, here’s the cream of the crop…

Founded in 2008 and based in Shanghai, CooTek (NYSE: CTK) is a mobile internet company best known for its TouchPal application. Together with a simulated keyboard, TouchPal uses a word-predicting technology that generates the most probable word or its spelling in more than a hundred languages. CooTeck also has mobile apps that address fitness, lifestyle, healthcare, news, short videos, and entertainment — and reaches an average of 213.7 million monthly active users around the world.

#-ad_banner-#CTK has been listed on NYSE only since last October. Since then, its share price has bucked the S&P 500 downtrend: with the market index down about 7% since the day of CTK IPO, shares of CooTeck have rallied some 20%.

While its projected long-term profit growth of more than 200% a year might look too good to be true, I can’t argue with other people’s estimates. And even if those estimates are half-correct, we are still looking at a company that perfectly fits any definition of growth — and a company that is a good fit to my definition of a game-changer. Let’s remember this name for the future.

I suspect most of us are more familiar with RE/MAX (NYSE: RMAX) — and most of us can bring up the mental image of its iconic red, white and blue Hot Air Balloon.

It could come as a surprise that RE/MAX, which since its 1973 founding has maintained a massive presence in the residential real estate markets in the U.S. and Canada, has been a public company for only five years. Its franchise model and 2% dividend yield make it an interesting income candidate, but it does not fit our profile over at Game-Changing Stocks, despite the projected profit growth.

Fang Holdings (NYSE: SFUN) is also a real estate company, but it’s quite different from RE/MAX. It’s a real estate internet portal in China, and, according to the company, it’s the largest portal in terms of the number of page views and visitors to its websites.

I’m skeptical about SFUN’s expected profit growth, though: its annual revenue has been on the decline since peaking in 2016. Worse, in 2017 — the last year of full data — it was cut by more than half ($444 million vs $916 million), and for 2018 it’s not expected to have improved: $319 million in revenue is predicted for the full year. I would stay away from this company.

Primo Water (Nasdaq: PRMW) provides multi-gallon purified bottled water, self-service refill water, and water dispensers in the United States and Canada. This could be a great company to keep in mind for the future, but for now, I just don’t see many game-changing qualities in its profile.

Finally, there’s Model N (NYSE: MODN). My long-time readers might remember this revenue management cloud company for the life sciences and technology businesses: we sold its shares a year ago almost to the day, for a gain of 30% in about six months. I like MODN’s business, and with long-term projected growth of 44%, now might be the time to revisit the shares. If you’re a subscriber to Game-Changing Stocks, stay tuned…

P.S. While the stocks in this screen might be winners, there’s a group of picks I’m even more excited about… You see, each year we release a report with big, bold predictions for the coming year. Some of them are controversial — but they all have triple-digit-plus potential for investors as we head into 2019. And you can find it all in my latest report: 9 Game-Changing Investment Predictions for 2019.

To learn more about our predictions for this year, go here now.