Analysts Project Big Upside For These 9 Dividend Payers

Occasionally, I give Wall Street analysts a tough time. They tend to have a herd mentality, are myopically focused on the short-term, and are reluctant to downgrade stocks until trouble goes from bad to worse and the damage has already been done.

That’s a bit like yanking a tiring pitcher after he’s surrendered a big home run.

#-ad_banner-#But I never question the intelligence of these professionals, or their knowledge of the industries they cover. Spending all day, every day, analyzing one specific group (whether its airlines, utilities or biotechnology) affords a deep understanding of those businesses and their operating environments.

I might not always agree with their conclusions, but if an analyst says a retailer’s debt maturities look problematic or a manufacturer might benefit from favorable foreign currency translation, I value their insight and opinion. They know who is gaining market share, where regulatory changes are headed and when disruptive new products will be released.

They also know how stock prices behave. So, I find their target prices informative.

Take wireless tower owner Crown Castle (NYSE: CCI), a former holding in my premium newsletter, High-Yield Investing. In late December, with shares trading near the $100 mark, analysts had a consensus target of $118, implying upside of almost 20%.

Today, CCI is trading at $118 and change.

The Screen

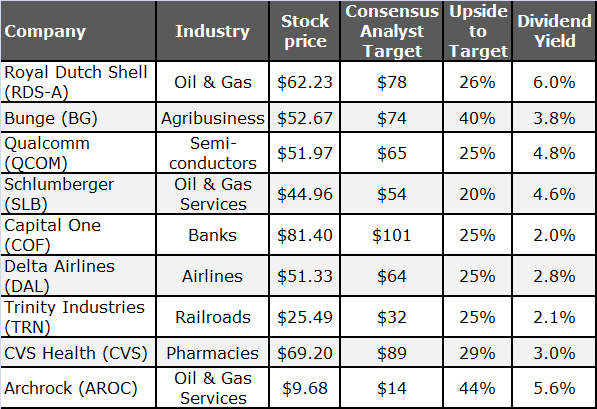

With that in mind, I went out in search of stocks currently trading at sharp 20% to 30% discounts to their targets. Of course, potential upside is only one consideration.

To help weed out some troubled companies, I conducted a secondary screen looking for candidates with 10% or better projected earnings growth this year. That gives us a narrow pool of stocks that are arguably underpriced, but also have an upbeat outlook. As always, I only selected finalists with above-average dividend yields.

Here’s what I found.

Action to Take

Of course, an analyst’s target price shouldn’t be considered gospel. And they aren’t set in stone, either. But as the saying goes, two heads are better than one. And in some cases, these targets represent the collective thinking of six to eight analysts.

As it happens, I am familiar with about half of these stocks. Archrock (Nasdaq: AROC), Qualcomm (Nasdaq: QCOM), Schlumberger (NYSE: SLB, and Trinity Industries (NYSE: TRN) are all interesting names that I’ve either owned in the past or have written about recently over at High-Yield Investing.

Aside from these, I’ve got my eye on Royal Dutch Shell (NYSE: RDS-A). Even with volatile crude prices, the company delivered 32% earnings growth last quarter and generated a whopping $22 billion in operating cash flows. Shell is dishing out $3.9 billion in quarterly dividends to go along with aggressive share repurchases ($4.5 billion over the last 12 months).

Key growth projects coming online could help speed up the stock’s trip to a target destination in the upper-$70s. In the meantime, investors can pocket a healthy yield nearly triple the market average.

Remember: The stocks in the table above haven’t been fully researched and shouldn’t necessarily be considered portfolio recommendations. These securities simply meet specific screening criteria that make them worthy of additional consideration. If I like Royal Dutch Shell (or any of the other names mentioned in this screen) as a solid “buy,” then my High-Yield Investing subscribers will be the first to hear about it.

That said, feel free to research the stocks in this screen on your own. There could easily be a couple names here that offer investors high dividend yields along with significant price appreciation — the best of both worlds.

P.S. If you’re hunting for income, then it pays to look beyond the usual suspects… That’s what we do each month in my premium newsletter, High-Yield Investing. In fact, my subscribers are earning thousands in extra income each month — enough to live a comfortable, worry-free retirement. If you’d like to join us in our search for the best high yields the market has to offer, go here right now.