The ‘Father Of Value Investing’ Led Me To These 5 Picks…

Value investing is one of the most popular investment strategies used today by individual investors and portfolio managers.

Value investors seek out stocks that can be purchased at a discount to a company’s “real” worth. It’s an approach that’s been refined over the years, but its foundation goes back roughly 85 years with the publishing of Benjamin Graham and David Dodd’s college textbook, “Security Analysis.”

Benjamin Graham is properly credited as one of the fathers of value investing. Disciples of his include such notables as Warren Buffett (who is reportedly the only student to receive an “A” in his class), Walter J. Schloss, Seth Klarman, and Bill Ackman.

Graham’s approach was to identify stocks that were trading at a discount to their intrinsic value. And although Graham never fully explained how to determine “intrinsic” value for a stock, we do know that he felt a firm’s tangible assets were a particularly important component. Other factors included earnings, dividends, financial strength, and stability.

Graham knew that identifying such neglected, undervalued stocks was a protracted and patience-trying experience. But he also knew the rewards could be great. And so did his most famous student…

| —Recommended Link— |

| The most powerful market research you’ll ever get your hands on… Free? Get your hands on Jimmy Butt’s “little black book” for free. This in-depth report outlines the top 10 stocks he believes will bring in explosive gains in 2019. Click here to claim your copy now. |

Buffett snapped up shares of many of the big-name banks, including Bank of America (NYSE: BAC), shortly after the bottom of the financial crisis. Shares were trading for under $10 at the time of his purchase. Today, shares are trading for around $30 — which means Buffett is sitting on gains of more than 450%.

Margin of Safety: The Forgotten Component

Graham believed that focusing on the intrinsic value of a business would help investors avoid fly-by-night companies and stocks caught up in market euphoria (think dot-com companies leading up to 2001).

Surprisingly, Graham’s approach wasn’t necessarily designed to produce market-beating returns (at least that wasn’t his intended goal). Instead, it was aimed at helping investors reduce the risk of misjudging a company, and thus the loss of capital.

But over time, and as Buffett has repeatedly proven, this approach to the market can produce staggering returns.

I recently used a “Graham” approach to find potential bargain stocks for my premium newsletter, Top Stock Advisor. More specifically, the screen I shared with my readers is based on Graham’s “Enterprising” methodology as defined in his book, “The Intelligent Investor.”

This approach seeks stocks that are trading at a discount to future earnings, and, ideally, stocks that are trading for less than their net working capital — in essence buying companies without paying for their plants and machinery, or any tangible assets.

Of course, it is necessary for investors to distinguish between undervalued stocks and those that are properly selling at low prices relative to value, sometimes referred to as “value-traps.” In order to help avoid these types of situations, Graham suggested looking at companies that have had stable earnings over the last decade, with no years of negative earnings.

Let’s Use Ben Graham’s Teachings To Screen For Picks

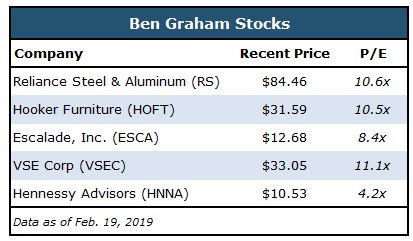

So that’s what I looked for this week, and here’s what I found…

While all five of these stocks are worthy candidates for further vetting, I would focus my efforts on these three…

Reliance Steel & Aluminum (NYSE: RS) operates as a metals service center in the United States and internationally. It provides steel, aluminum, stainless, and specialty metals, as well as processing services to customers in various industries.

#-ad_banner-#The company is trading at an earnings multiple of only 10.6 times the stock price, well below the S&P 500’s P/E multiple of 19.7. It’s also below the company’s average five-year historical P/E ratio of 16.1. The company posted double-digit sales growth in 2017 compared with 2016 and is on track to grow sales by double-digits again for 2018. The company will have reported fourth-quarter and full-year results on Feb. 21 — just before you’re probably reading this, so be sure and check out the numbers in the report. The stock also sports a dividend yield of 2.4%.

Next, I’d look at Hooker Furniture (Nasdaq: HOFT). This small-cap stock ($370 million market cap) designs, manufactures, imports, and markets residential household furniture products in the United States.

As one of only two retail stocks that made it through the screen, that in of itself is rather remarkable. A handful of retail stocks met most of Graham’s requirements until it came to positive earnings over the last decade. The financial crisis in 2009 eliminated all but Hooker Furniture and Escalade (Nasdaq: ESCA) from the screening process.

Hooker currently sports a P/E multiple of 10.5, which is again below the broader market’s 19.7 P/E. While its dividend yield of 1.9% isn’t anything to write home about, the company has grown sales at a compounded average growth rate of 22% over the last five years. The one analyst who covers Hooker Furniture also seems positive on the stock, as he has a price target of $43 per share, a 36% premium to its most recent closing price.

Finally, we have Escalade (Nasdaq: ESCA), another small company (market cap of only $177 million). This is a sporting goods company that manufactures, imports and distributes various sporting goods brands in a variety of sports: basketball, archery, ping-pong, fitness products, and indoor and outdoor recreation games.

The company produced $173 million in sales and $24.3 million in profits in 2018. While the sales figure was down 3% from the previous year, profits rose 14%. The stock also boasts a dividend yield of 3.9%, double the S&P 500’s 1.9% yield.

Action To Take

These “Graham” stocks are a great starting point for further research. I do not — I repeat, I do not — recommend buying these stocks merely because they pass the criteria I laid out for this screen.

That said, it’s always worthwhile to apply the wisdom of legends like Ben Graham (or Buffett) in your research. That’s what led to many of the biggest winners we’ve had in Top Stock Advisor over the years — and it’s also what led me to my picks in my latest report: The Top 10 Stocks for 2019.

While most investors are chasing the latest “hot tip” thinking they’ll nab triple-digit gains each and every time, my readers know better. This is more like gambling, not investing. Instead, we’re playing the smart game, learning from greats, and applying what we know about “what really works” to each and every pick we make. And that’s what you’ll find in our latest report. To learn more about it, go here.