5 Promising Biotech Stocks That Could Be Takeover Targets

In a previous article, I talked about the so-called patent cliff and the correlation to the pace of mergers and acquisitions in the pharma space.

In order to help make up for the revenue that will be lost from expiring patents on blockbuster drugs, big pharma, flush with cash, typically goes out and buys a new revenue stream — in the form of companies that have a proven or promising drug in the pipeline. After all, it can be cheaper and more efficient for big pharma to buy a new drug than to develop one in-house.

We live this notion every day, both as investors, observing and often benefitting from M&A in the industry, and as consumers, feeling squeezed by the rising costs of many important medications — a process that, in part, stems from the reduced competition (which is also a consequence of a more intense M&A).

#-ad_banner-#But the trend is clear, as is the need and the drive of the larger companies to buy their smaller counterparts. It’s the safer route in an environment where new drugs take a long, costly and risky road from an idea to the market.

Of course, it’s not only the revenue stream that gets hit when a successful drug — a drug that typically costs billions of dollars to develop and market — loses patent protection. It’s also a risk — measurable in time and money and market value lost — when a prospective drug fails in clinical studies.

And almost any clinical study poses a risk.

Just last Thursday, March 21, Biogen (Nasdaq: BIIB) and its partner, Japanese biopharmaceutical company Eisai (OTC: ESALY), said that their experimental Alzheimer’s therapy, which at that time was at the second stage of clinical trials, was a bust. BIIB dropped 29.2% on the day, and ESALY by 35% on the same day.

Of course, this is not to say that new research and new drugs aren’t paying off for many companies and their investors.

Let’s take the same BIIB as an example. Before dropping more than 29% on March 21, shares of Biogen soared more than six times (or 522%) in 10 years on the strength of its own drugs (including the best-selling MS drug Tysabri) and helped by the 2003 merger with IDEC Pharmaceuticals.

But the drug business is as risky as it is rewarding. And investors (both venture and retail) take on some of the risk, too.

So, how can you and I minimize this risk? By looking for biotech stocks with just-approved or recently approved drugs, or drugs that have been in the market for a while that have the potential to be extended across a variety of applications. Such biotechs have a long-term promise of their own — as well as the promise of a quick profit as an M&A target.

In the previous article I referenced, I also promised to give you my analysis of which companies could be, in my view, takeover targets for others.

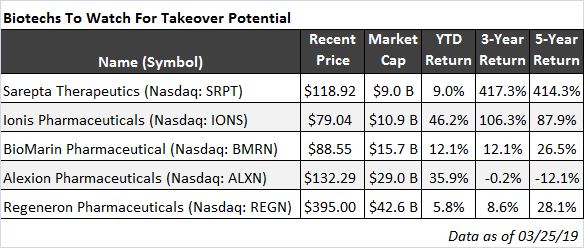

The companies on in the table below have one key factor in common: they all have at least one product already approved by the FDA.

Covering a variety of medical problems, and ranging in size from $9 billion to just over $40 billion in market cap, each of these companies can be attractive in its own way to a suitor looking to supplement its revenue stream or its new-drug pipeline. Let’s take a look…

Some of my readers may know Sarepta (Nasdaq: SRPT) well. This $9 billion gene-therapy company already has an FDA-approved product. Exondys 51, the first-ever FDA-approved treatment for a rare but deadly genetic disease called Duchenne muscular dystrophy (DMD), is already on the market. And just last month, the FDA granted priority review for SRPT’s second treatment for DMD, golodirsen, for DMD patients with a different genetic mutation.

With over 20 therapies in various stages of development and research focused on RNA, gene therapy and gene editing, SRPT could become a prime takeover candidate sooner rather than later.

Ionis Pharmaceuticals (Nasdaq: IONS), just a tad bigger than Sarepta, is another potential takeover candidate. Founded in 1989 and public since 1991, IONS, unlike many of its peers, has already broke even (in 2017), and expects to remain profitable from now on. On top of this, IONS has more than $2 billion in cash and equivalents on the balance sheet.

Over the past three years, IONS has had three drugs approved, and, in the near term, five more approvals are likely. No wonder the shares are up more than 55% year-to-date — investors are bidding up the price not in a small part thanks to the takeover potential. Still, with its expertise in a wide range of diseases, from neurological to cancers to rare genetic (such as Huntington’s) to cardiometabolic, Ionis is a company that is strong in its own right.

Founded in 1996, rare genetic diseases specialist BioMarin (Nasdaq: BMRN) has been around for a while. And it’s been successful, too, with seven products already on the market. One big problem, though — BMRN has not yet managed to break even. But the negative net-income streak is about to end this year, as the company is expected to earn $0.85 per share in 2019 (on $1.7 billion in revenue) and $1.75 next year (on $2 billion of revenue). On the verge of profitability and with a strong pipeline, BMRN also looks good as a potential takeover candidate.

A rare-disease pioneer, Alexion (Nasdaq: ALXN) is profitable, thanks to its blockbuster drug Soliris approved back in 2011. Last year, ALXN generated more than $3.5 billion in revenue from Soliris, an increase of 16% compared with 2017. Focused on hematology, nephrology, neurology, and metabolic disorders, Alexion has a bright future. This is why I profiled ALXN in more detail in my most recent issue of Fast-Track Millionaire.

The largest company on the list, with a $42 billion market cap, Regeneron (Nasdaq: REGN) would clearly need the largest suitor (and its group of potential bidders is, therefore, the narrowest) if the company were to become a target. But it’s a promising company on its own — and the one that, on the basis of its existing major drugs, as well as nearly two dozen more in the pipeline, deserves our attention.

Focused on a wide variety of areas, from eye diseases, to allergic and inflammatory diseases, to cancer, to cardiovascular and metabolic diseases, and more, with seven approved medicines and more than 20 in the pipeline, REGN deserves to be in this list.

Action To Take

I’ve been telling my Fast-Track Millionaire readers for months now that we’re on the cusp of a revolution in medicine. That’s why we’re devoting so much time and focus on promising biotech stocks. After all, by doing our homework now and carefully investing in a select handful of these innovative companies, our chances of having some big-time winners on our hands is more than strong.

Any one of the companies on this list is worthy of further research. But I should warn you… this space requires some heavy digging. Why not let my research staff and I do the heavy work for you? If you’re interested in learning more about what could be the biggest wealth creation opportunity of our lifetime, go here now…