Why You Shouldn’t Panic When Markets Get Volatile

Just as with many simplified strategies, the “Sell in May and go away” maxim often rings true.

But investors who follow this kind of advice could be setting themselves up for failure.

Take this past May, for example.

The market became more difficult as stocks began to slide. As of Friday, May 31, the Dow Jones Industrial Average, an index that measures the performance of blue-chip stocks, declined for the entire month, about 6.5% total. The broader market, as measured by the S&P 500 index, which set a record on April 30, declined by 6% or so as well.

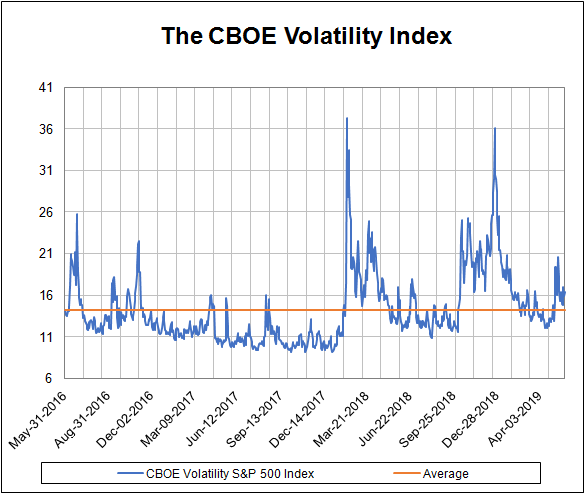

And the CBOE Volatility Index, also known as the “fear index,” traded above the three-year average for nearly the entire month.

In all honesty, though, we’ve been spoiled.

While we are still in bull-market territory (notwithstanding the recent pullback, which has not broken the uptrend), investors are less accustomed to volatility, having had 11 years of a bull market without meaningful corrections. And the market still trades near its all-time highs, despite the headlines. That’s a good sign. Strength, after all, begets strength.

But the higher the market goes, the more it feels — to individual investors and to professionals – as if we are getting close to an inflection point. And this, in turn, might mean a more difficult market and higher volatility going forward.

And yet, it pays to stay invested. Nobody can successfully time the market, not as a matter of long-term planning anyway. This means investors are better off making adjustments to their strategies — but sticking with the best this market has to offer.

#-ad_banner-#Look, I get it… The rising unease is definitely a factor here — and it can be tempting to wash your hands of a stock (or even your entire portfolio) when things get volatile. But that’s how markets work.

It’s worth noting, however, that this uncertainty also creates stronger demand for safe-haven assets. For example, the 10-year benchmark Treasury yields have declined to their lowest levels since October 2017.

And because price and yield move in the opposite directions for bonds, this means a strong gain for the hedge we own in Fast-Track Millionaire — the Vanguard Extended Duration Treasury Index ETF (NYSE: EDV), which rallied nearly 6% in the month of May, nearly 9% year-to-date and 18% since we added it to our portfolio on November 27.

If market worries accelerate or if the trade war gets more heated, our market hedge could continue to deliver. The point is, if market volatility affects you psychologically, then employing a hedge can help you remain calm.

Action To Take

Technology is one of the sectors where gains can continue. That’s because many of these companies are defined by their market-share gain against old-school companies and because many are largely immune from the potentially devastating impact of trade wars.

Another sector is health care. Here again, the health-care stocks that are the focus of our portfolio over at Fast-Track Millionaire are poised to benefit from the latest breakthroughs in medical advancements. While not entirely exempt from the market action and market volatility — these are all equities, after all — they are much more likely than their peers in more established sectors to decouple from the market.

Of course, what works on the way up also works on the way down. The “decoupling” for tech and biotech innovators could well work the other way — if they don’t execute, the stocks could decline even in a rising market.

Still, a strategy of selecting best of the best — stocks that can and do outgrow the market — is a strong long-term strategy that has already delivered a number of strong gains for our portfolio. And that’s why I recently issued a brand new report about the market’s next major growth sector: marijuana stocks.

I know what you might be thinking… but this is already big business we’re talking about here — and believe me, it’s only going to get bigger. In fact, my report explains how the House is about to vote on a key bill any day now that could lead to full legalization — and you’ll want to know which stocks to own before that happens. If you’d like to learn more, go here now…