Where Have All The Good Deals Gone?

Nobody said this would be easy…

Today’s market environment brings a lot of uncertainty. The volatility we’ve seen recently brought on by the continuous trade war with China to a possible looming recession as indicated by the yield curve has investors on edge. Even the highly anticipated interest rate cut July 31 by the Federal Reserve was met with skepticism as the market sold off on the news.

To top it off, the market — and many stocks — are sporting lofty valuations, which makes it difficult to find that “great company trading at a discount” we’re all looking for, much less even a fair price.

| —Recommended Link— |

| 3 Minutes to Collect 12 Times More Money Than Social Security |

No Stone Left Unturned

For instance, I recently looked into the utility sector. And while there are plenty of companies I like, it was hard to pull the trigger on one — mainly because my focus is buying great companies at fair prices… and I didn’t find any trading for what I believe to be fair prices.

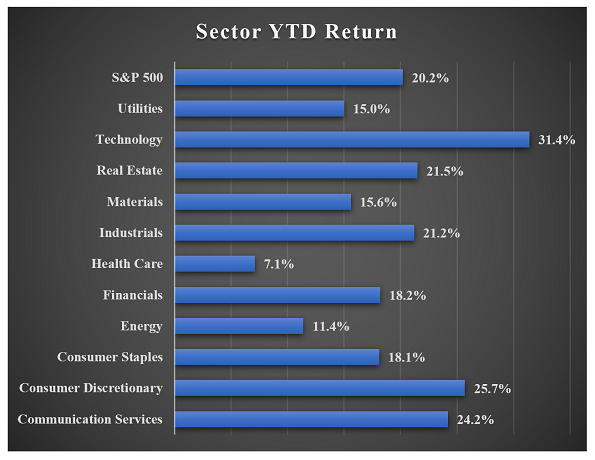

Utilities, which have had a wonderful year so far (up nearly 15% year-to-date), are trading as a group at a price-to-earnings multiple of 24.7, which is more than the S&P 500’s P/E of 21.2. Think about that… These supposedly “defensive” stocks, which typically offer little in the way of growth, are more expensive than the market.

Over the last five years, each time the P/E of utilities traded at a premium compared with the S&P 500, they went on to underperform over the next 6-12 months. So much for utilities.

I then dove into the healthcare sector, which has also been the worst performing sector this year.

Surely, I’d find some great companies trading at a discount… And while I did find a couple that piqued my interest, I found too many risks to justify the rewards.

I looked at former holding CVS Health (NYSE: CVS) whose shares were down as much as 20% this year. But once again, on a valuation basis the stock wasn’t screaming “buy.”

Next, I dove into another former holding from the health sector: Bristol-Myers Squibb (NYSE: BMY). This biotech has a portfolio of cancer-fighting treatments in Opdivo and Yervoy, as well as blood thinner Eliquis. The stock has been struggling ever since we sold it in June 2018, down double-digits since then.

Unlike CVS, Bristol-Myers Squibb is dirt cheap. The stock is trading at five-year lows on a P/E and EV/EBITDA basis.

There’s a lot to like about Bristol-Myers. It generates billions in sales ($22.6 billion in 2018) and produces consistent free cash flow (roughly $5 billion last year). It also has a strong portfolio of drugs on the market, and a good pipeline of drugs going through the FDA approval process. However, with the uncertainty surrounding a merger with Celgene (Nasdaq: CELG), and the company losing ground to Merck’s (NYSE: MRK) cancer-fighting drug Keytruda, it leads me to believe that the stock will mostly tread water for the next year.

To top it off, I believe the health sector will take some heat in the upcoming presidential election cycle. That’s especially likely with pharmaceutical and drug companies, as there have been a lot of questions, concerns and debates surrounding the drug prices. That focus will likely continue to grow as the election races pick up steam.

Why Even Bother?

Long story short, I worked my way through nearly every sector and numerous stocks doing this sort of bottom-up analysis — looking at a firm’s valuation, how it stacks up to peers, sales and earnings growth, cash flow growth, projected growth, etc. Then I slowly made my way out to the bigger economic picture with each stock.

It’s a slow and tedious process. Quarterly and annual filings aren’t exactly page-turners. But it’s a necessary process. Sometimes you can uncover fantastic little gems. Other times you can come across a company that’s been sitting right under your nose.

I don’t bring all this up to discourage you. I just want our readers to understand just what they’re up against when it comes to finding a good deal in this market. Fortunately, the payoff can be worth the effort.

For example, back in October 2017, after a similar exhaustive search, I finally found one of those “right under your nose” situations. I wrote: “Sometimes that perfect stock is sitting right there in front of you the entire time. A wonderful company that generates enormous amounts of cash flow… has a history of rewarding shareholders through dividends and share buybacks… and is trading at a discount.”

In that issue, I was talking about (and recommended) coffee chain Starbucks (Nasdaq: SBUX). The stock has delivered a wonderful 84% return since then. For comparison, the S&P 500 has gained only 12%.

Editor’s Note: If you’re looking to retire early (or just want to stay retired), then you need to see this…

A former military intelligence officer has discovered a secret that could triple your monthly income. Best of all, it only takes a few minutes each week once you’re all set up. To learn more and see if you qualify, go here now.