Forget Bonds, This Is A Better Way To Generate Income…

A couple of weeks ago, I wrote about the potential pitfalls of a traditional portfolio approaches like the 60/40 model.

In short, I said that for those looking to retire (or are already retired), the income generated from that 40% allocation in bonds probably isn’t going to cut it.

In this market, where the Fed has kept interest rates at historic lows, it’s more important than ever for income-minded investors to look beyond income stocks and bonds.

That’s where my time-tested options strategy comes in.

Options, Demystified

Contrary to what most investors think when they hear the term “options,” there are a couple ways to conservatively generate income for a portfolio. In fact, given the risk factors I’ve outlined, I think they’re the best way to consistently produce income.

Contrary to what most investors think when they hear the term “options,” there are a couple ways to conservatively generate income for a portfolio. In fact, given the risk factors I’ve outlined, I think they’re the best way to consistently produce income.

Selling put options is one strategy that could be beneficial. For the sake of time and space today, I will only briefly recap how this works. Instead, I want to spend most of our time talking about how this strategy could fit into a portfolio.

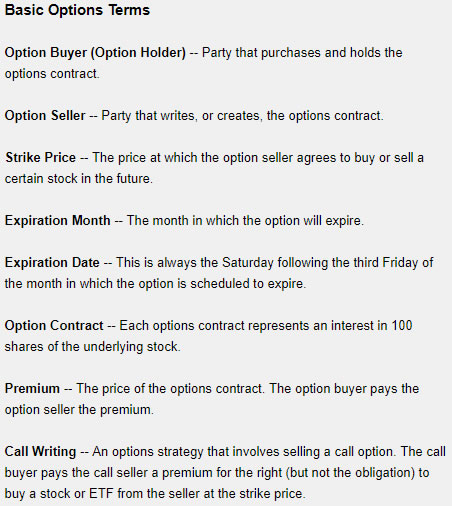

But first, the basics…

When you sell a put, you will generally sell it at a strike price that is below the current market price. This, in turn, generates a premium – which is income that we get to keep regardless of the future outcome.

Unless the price of the underlying stock or ETF falls below the exercise price, the put will expire worthless. That’s a good thing for us, since it means we can keep the income and move on to other opportunities.

To minimize the risks of put selling, you should only sell put options on stocks or ETFs that you would like to own. For example, if SPDR S&P 500 ETF (NYSE: SPY) is trading at $415 and you would like to buy it on a 10% pullback, you could sell a put at $374 that expires in one to two months. This allows you to earn income while waiting to buy at your desired price. The caveat is that if SPY falls more than 10% you will still have to buy it at $374.

There’s more to say about this, but let’s talk about how this could fit within a broader portfolio strategy…

A Replacement For Bonds?

Put selling could replace part of the fixed income allocation in a traditional 60/40 strategy. If you are considering a strict asset allocation strategy, you could consider options selling within the fixed income portion. The risk profile of options selling (especially the way my readers and I do it) will be similar to the risks of a portfolio of high yield bonds.

That insight provides one way of thinking about how much to allocate to selling options. The strategy could be a substitute for corporate bonds without the long-term risks that bonds carry.

Once you decide how much to allocate to the strategy, you need to decide on the tactics of trading. Here, an example could help.

Say you have decided to allocate $15,000 to this strategy. If you use margin, your broker will allow you to increase your income significantly. With $15,000, you could sell options on stocks worth more than $75,000.

With that much capital, you could consistently have three positions open at any given time with two contracts for each position. Each position will be open less than 90 days, and sometimes less than 30 days. But, to be conservative, let’s estimate that you have three positions open at all times and are able to generate income 12 times a year.

Now, let’s be conservative and estimate each contract generates $40 in income. That would be $80 per trade since there are two contracts in each trade, or $960 a year in income. (Again, this very achievable.)

On a $15,000 account, these small trades would provide an annual yield of 6.4%. And that’s being conservative. You could easily enjoy double-digit income since most trades are open for about six weeks. If three positions are opened every six weeks, the yield jumps to 28% on a $15,000 account.

The Takeaway

Again, this is just a baseline. Your actual income could be significantly more or less than that. But, given what we’re up against, it’s clear to me that income-oriented investors are going to need new strategies at their disposal. And I’m confident that the total returns of bonds will almost always be less than the income from a put selling strategy.

Think about it… This strategy allows us to get paid instantly, rather than simply sitting on a bond and waiting to get paid. It also affords us flexibility — we can respond to the market in ways that bond holders simply can’t.

There’s a lot more to say about how this works — and that’s why I’m here to help. That’s why if this sounds even remotely appealing to you at all, then I strongly encourage you to check out my latest presentation.