This Simple Move Could Save You A Lot On Taxes This Year…

Today, I want to talk about something that is especially important as we enter the closing weeks of the year.

In between making plans to spend time with family for the holidays and shopping, this is a matter that may require your attention, depending on your situation.

It has to do with taxes on your portfolio, and how just a couple of smart moves can help limit your bill for this year. I know we’ve all got a lot of other things on our mind this time of year, but this is an important part of managing a successful portfolio that a lot of investors tend to ignore.

Remember how back in early October, I told the story of how a new trader got slapped with an $800,000 tax bill because he wasn’t familiar with the wash sale rule?

What I want to discuss today is in a similar vein. Let me explain…

Why Tax-Loss Harvesting Could Be Especially Important This Year

You see, we’re entering the time of year that’s otherwise known as tax loss harvesting season. And if you’re like my subscribers over at Top Stock Advisor, it could be especially pertinent this year. That’s because we’ve had a spectacular year so far, as I touched on in this piece, a couple of weeks ago.

Now, before I go any further, I do want to point out that tax-loss harvesting is NOT useful in retirement accounts, such as a 401(k) or an IRA, because you can’t deduct the losses generated in a tax-deferred account. So, tax-loss harvesting is only good for regular brokerage accounts.

But let’s say you’ve been following along with the moves we’ve been making over at Top Stock Advisor. Our total portfolio has grown roughly 35% in value so far this year, outpacing the S&P 500’s strong 25% return.

We’ve had some wonderful recent winners, too. One of our holdings, a homebuilder we added back in March, is up triple digits (105%). Our “gaming infrastructure” pick has ripped off a 128% return in just six months. Meanwhile our “boring” insurance company — American Financial Group (NYSE: AFG) is up a whopping 194% in only 14 months.

This is just the tip of the iceberg. And it’s all on top of the positions we closed out on this year… 32% from Southwest Airlines (LUV) in two months, a quick 42% from Rocket Companies (RKT), and 46% from NMI Holdings (NMIH), which we closed out earlier this month.

I could go on, but I think you get the idea.

The point is, those are some big gains. Compare that to just one loss we’ve booked this year, which lost us just 8%. And even if you haven’t been following our moves over at Top Stock Advisor, you may find yourself in a similar position. (Like I said, it’s been a great year for the market in general, too.)

Between the profits we’ve already closed and the big gains that we’re currently sitting on in many of our holdings, nobody could blame you for booking even more profits.

There’s just one problem. We we can’t forget about Uncle Sam, as he’s eagerly awaiting his cut. It’s a good problem to have, of course, and this is where tax-loss harvesting can help us out…

Why Tax-Loss Harvesting Could Be Beneficial

As much as we would all like to bat a thousand, the cold hard truth is that not every investment will be a home run. When we do strikeout, the only silver lining is that we could use that loss to lower our tax liability.

Generally, tax-loss harvesting looks like this:

- Sell an investment that’s underperforming and losing money.

- Then, use that loss to reduce taxable capital gains and potentially offset up to $3,000 of ordinary income (more on this in a sec).

- Finally, reinvest the money from the sale into a better opportunity.

Take this year’s Top Stock Advisor portfolio performance as an example. We’ve already booked some nice gains this tax year, and we’re sitting on plenty more that some folks may want to pull some profits on.

These gains could all add up to a nice windfall, but on the flip side, it will also trigger a significant taxable gain.

To help offset those gains, maybe you’re sitting on some losers that you’ve lost faith in, or you’ve given up on. Or maybe you have a holding you just want to get rid of but haven’t quite mustered up the courage to cut the loser from your portfolio.

Whatever the case might be, tax-loss harvesting just might be your answer. It might be what you need to get you over the hump and make the decision to cut the losing position once and for all.

One thing to note is that this strategy could be beneficial even in a down year where losses outweigh gains. In this case, you can use the losses to offset up to $3,000 or your ordinary income for married couples and $1,500 for single filers. Any amount over $3,000 can be carried forward to future tax years to offset income down the road.

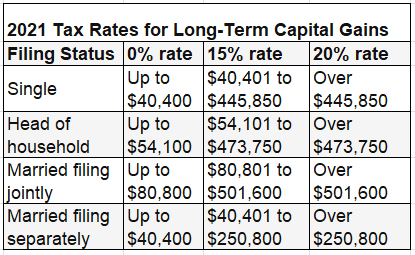

A quick reminder: When you sell an investment for a profit, you owe capital gains taxes on the profits based on how long you held the asset. If it was owned for less than one year, it’ll be taxed at your normal income tax rate. If held for more than one year, it’ll be taxed at the preferential long-term capital gains rate, which could be as low as 0% and no higher than 20%, even for top earners.

Action To Take

Mutual fund managers and hedge funds routinely use this tax-loss harvesting strategy every year to help lower the taxes owed. And it could save you a pretty penny when it comes to taxes this year. Again, this strategy isn’t helpful for tax-deferred accounts.

Of course, I’m no tax expert, so you should always check with a tax pro to see if tax-loss harvesting is best for your situation… and no, Turbo Tax isn’t a tax pro.

But take my advice and carve out some time to look over your portfolio before the end of the year. See if there are any losers you’d like to cut in order to offset the liability you may be facing from some of the big winners you may have scored this year. Chances are, you’ll be glad you did.

P.S. By now, everyone knows about the furious competition taking place to see who will take the top spot in space. We think Elon Musk is in the lead right now, thanks to his latest brainchild — Starlink — that’s about to go “live” soon…

My latest report tells readers all about this secretive project and what it could mean for the future of space (and life here on earth). And even though Starlink is “off limits” to regular investors, we’ve uncovered a “silent partner” that’s tradeable right now and gets you in on the ground floor…