How Betting With The House Can Lead To Major Long-Term Winners…

In all of my experience with investing, there are a few things that just seem to work year after year.

One of those things is by betting with the house.

If you’ve been to Vegas, then you know what I’m talking about. “The house always wins” is a phrase we’ve all been taught – and some of us have learned the hard way.

There are a number of ways you can take this idea and apply it to investing. For example, think of the credit card company, Visa (NYSE: V). Every time you swipe your Visa card, the merchant must pay a small transaction fee to Visa for facilitating the purchase.

In a way, Visa is the house. It doesn’t matter if the consumer is in a good mood or a bad mood. It doesn’t matter if they’re flush with cash or on the verge of bankruptcy. The house always gets its cut. You can see how good this works out when you look at the 10-year chart of Visa below…

Longtime readers know I’m a big fan of insurance stocks, too (I talked about why in this piece). And as anyone who has seriously studied Warren Buffett knows, those have turned out to be fantastic long-term investments, too.

But there’s another approach we can take to this when we think about investing. I’m talking about the exchanges themselves. Here’s what I mean…

Another Way To Bet With The House

When you place a trade to buy 100 shares of a stock, your broker routes that order to a marketplace that has a seller for that stock. Then, your broker will pay a transaction fee to that exchange for providing the liquidity and a marketplace for that transaction to take place.

The exchanges act in a similar fashion. Despite the “no-commission” trades that many brokerage firms now offer retail customers, these brokerages still must pay a fee to the exchange on which it participates.

The beauty of providing a marketplace for these transactions to take place is that it’s also extremely profitable.

My favorite of this group is CME Group (Nasdaq: CME).

There are a lot of reasons to like CME. Perhaps one of the most important for today’s market is the firm’s reliable and resilient income stream.

CME’s business — at the heart — is exactly the same as it was when the firm started as the Chicago Board of Trade a century and a half ago. It provides a marketplace where buyers and sellers can get together to buy and sell futures contracts.

The big thing that’s changed is the array of products offered by this now-global trading platform. CME’s futures offerings span interest rates, equities, foreign exchange, agricultural commodities, energy and metals. Every day, CME is the intermediary for millions of options and futures contracts. Fortunes are won and lost on some of these trades, but the outcome doesn’t really matter.

Either way, CME takes a cut.

Thick Margins, Generous Dividends

In 2021, the company brought in about $3.7 billion from clearing and trade transaction fees. This accounts for about 80% of its business. The remaining revenue comes from its market data, information, and “other” segment, which generated north of $900 million, bringing total revenue to nearly $4.7 billion.

Not a bad chunk of change for providing a marketplace where goods are exchanged. No inventory to worry about, no shipping or fuel costs, either. In fact, its biggest expense is employee wages and benefits, costing the company just $837 million annually.

This allows CME to boast operating margins of 56% and net margins of 56%. To put that into perspective, compare it to a retail company like Wal-Mart (NYSE: WMT) that has operating margins of only 4.5% and net margins of 2%.

For a company to have such consistent and reliable income is a godsend, but it also makes it tough for a firm to produce record-breaking sales or cash flow results. That’s the case for CME. But that’s okay. It steadily churns out enormous amounts of cash, and it turns around and gives that cash back to shareholders in the form of dividends and special dividends.

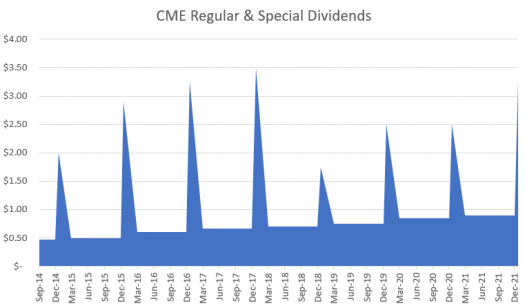

Not only does it consistently pay out quarterly dividends, but it also annually dishes out a special dividend which is an amount that’s nearly equal to its total annual dividend. For example, in 2021, it paid a $0.90 quarterly dividend or $3.60 for the entire year.

Then in December, it declared a special dividend of $3.25 per share. But here’s the thing… you won’t typically see this special dividend calculated in the stock’s dividend yield. For example, a quick glance on Yahoo Finance show’s CME has a dividend yield of roughly 1.6%… yet, that’s not telling the whole story. You see, when you include its special dividend in its yield calculation you get a dividend yield close to 3%.

Closing Thoughts

Another perk is that CME actually thrives when the market is volatile (since more trading is done and CME makes a cut off of each transaction). And if there’s one thing we can be sure of, it’s that there will inevitably be some volatility in the market at some point. So, we might as well own a company that benefits from any sort of chaos that may ensue.

Over at my Top Stock Advisor premium service, we’ve owned CME since August of 2014. You can see how well that’s worked out for us in the chart below…

All told, we’re up 265% on CME, compared with the S&P 500’s 121% return during that time.

This is what happens when you own a high-quality, shareholder-friendly company with thick margins. It’s also what happens when you’re not only betting with the house – you are the house.

P.S. Every year, I gather a research team and go “rogue” to look for the best high-upside opportunities the market has to offer. And what we found this year might shock you…

After three months of research, we’ve finally released our 7 shocking market predictions for 2022. They run counter to conventional wisdom and are the most controversial market calls I’ve made in years… Past predictions have handed investors a shot at raking in 622%, 823% and even a whopping 1,168%.

How much could this year’s predictions bring in? See for yourself here.