Sitting On A Loser? Here’s The Best Way To Bounce Back…

We’ve all been there… After a string of good days in the market, we open our brokerage account to look. When we see a screen filled with green, it’s hard not to smirk and think we’re pretty smart.

But then there are the days when market volatility rears its ugly head. We open our account to see a sea of red on our screen and begin to panic.

While there’s no doubt that we’ve had a pretty good run the past several months, it’s easy to forget what it was like back in March 2020 when the COVID-19 pandemic was wreaking havoc on the market. To say that panic was ruling the market back then is an understatement.

We may not see panic like that for some time. But then again, who knows? Regardless of what happens, there’s something you need to remind yourself of now (when the times are good). If you get in the habit of remembering it now, you’ll be much more likely to remember it on those days when you see a bunch of red on your brokerage screen…

The emotion of losing money greatly overpowers the joy of making money.

We know this from human psychology — it’s been studied extensively.

How To Bounce Back From A Loss

We can log into our brokerage accounts and have a dozen stocks in the green, some even by double- or triple-digits. Yet, you see a few stocks in the red, and that’s where all the focus goes. We dwell on the losers and frustration mounts. But here’s something to keep in mind…

Losers are part of the investing game. How you deal with them is what can make or break your portfolio. You’re never going to bat for a thousand.

Even the greatest investors in history suffer losses. For instance, Warren Buffett has made more than his fair share of mistakes. One of the Oracle of Omaha’s greatest losers was his purchase in 1965 of a textile company. That’s right – Buffett himself said that it was a mistake to purchase Berkshire Hathaway, which was failing at the time. He’s estimated this mistake cost him around $200 billion in potential future returns.

But here’s the good news. You can learn a lot from your losses, arguably more than you can from your winners. However, when it comes to losers, most folks tend to make the same mistakes over and over again. They don’t have the discipline to cut them from their portfolio. The human tendency is to wait until the stock returns to even so you don’t have to sell for a loss. But red stocks don’t always go green.

Those losses often swell into even bigger losses, and soon, they become a giant black eye in the portfolio. “Surely it can’t go any lower from here,” you tell yourself. And once it does, you find another excuse to ride it out.

Losses happen. The trick is to control them.

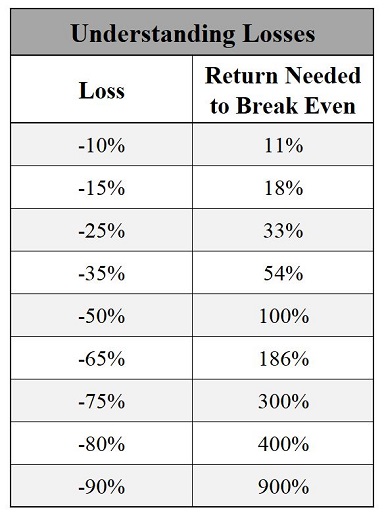

We’ve shown this table before, but it’s worth showing again. Look at what it takes to recover from a loss…

As you can see, if you suffer a 50% loss, you need a 100% return just to get back to even. A 75% loser? Extremely difficult to recover from. We’re not talking about making a profit – or celebrating the fact you booked a triple-digit winner — we are just talking about getting your original investment back. That can be disheartening, as triple-digit returns are not exactly a regular occurrence.

Action To Take

Knowing the best time to sell is tough, regardless of whether you’re looking at a profit or a loss. Nobody knows the exact top or bottom of a stock, or even necessarily the “right” time to sell a stock. But here’s our advice for the next time you look at your portfolio and review the positions trading at a loss…

When you’re wondering whether it’s time to cut them loose or hold on tight, review why you bought that stock in the first place.

Is your original buying premise still in place? What is the market seeing that you might be blind to? Keep an open mind and look at both sides of the equation. Look at the pros and cons of the company and its prospects.

The bottom line is that plenty of great investors get it wrong sometimes. What makes a great investor is how you handle your losses. You must be willing and disciplined to cut your losses. Bailing on a loser doesn’t mean you’ve failed. It means that you’ve succeeded… succeeded in avoiding even bigger losses.

P.S. There’s a simple way to build massive wealth without technical analysis, cryptos, or meme stocks…

If you’re ready to finally achieve financial peace of mind, just take a moment to review our latest presentation. You’ll learn about some of the strongest, safest and most generous income-producing stocks we’ve ever uncovered. Click here to learn more.