The U.S. Mint And A Billionaire Love This Unusual Company

Ken Griffin, a wunderkind of Wall Street, was managing a million dollars while still in college.

After launching Citadel Investment Group with just over $4 million, Griffin’s fund is now among the largest in the world, with over $40 billion under management. His fund is among my favorites for investment ideas.

Griffin recently made an unusual investment: He just took a nearly 6% stake in the newly public Global Brass and Copper Holdings (NYSE: BRSS).#-ad_banner-#

The company specializes in fabricating, processing and distributing specialized brass and copper products. While the company has existed since 2007, its books have been open for scrutiny only since its May IPO.

Global Brass, which recently posted impressive second-quarter results, appears solid, and Citadel’s investment increases my confidence. However, whenever I consider investing in a base metal fabricating company, I am reminded of my first experience in the field.

I made my first copper fabrication investment at 9 years old. I lost 99% of my capital, not counting transaction costs, on the investment. This experience was the first of many in the never-ending learning curve of the financial markets. Here’s what happened:

At that age, I was a voracious reader of pulp magazines and comic books. I particularly liked the small display ads that filled the back pages of these often mother-disapproved reading materials. I rarely had enough money to purchase the various toy flying machines, prank gifts and X-ray glasses, but there was a particular item that struck my fancy. It cost a dollar plus a quarter for postage and handling.

I couldn’t believe how inexpensive this fine copper artwork was and thought for certain it would appreciate greatly in value. The item was marketed as a genuine copper engraving of Abraham Lincoln — my favorite U.S. president — endorsed, dated and certified by the U.S. government. It was made out of real copper, had artistic collector value due to the engraving, and even the government supported it.

How could I go wrong with this investment? At the very least, my mother would be able to proudly display my acquisition above the living room fireplace while we waited for it to surge in value.

I carefully saved up five quarters, taped them inside an envelope and mailed the package away to New York City. Several weeks later, I received a small manila envelope that I quickly ripped open to see my first copper investment.

What I found inside nearly brought me to tears. It was a penny!

I ran back to the original advertisement reading it over and over again. I realized the ad described the penny exactly, and I had been completely scammed due to greed and stupidity. The urge to get something for nothing made me blind to the obvious. I never read an advertisement the same way again. To this day, every time I see a penny, I think of this experience and my first copper investment.

Clearly, Ken Griffen’s reasons for investing in Global Brass and Copper must be more solid. Let’s take a closer look.

Global Brass and Copper operates three companies: Olin Brass, Chase Brass and A.J. Oster. The products are used in a variety of markets, including munitions, building, transportation, electronics and industrial. In fact, if you’ve ever gone target shooting, it is likely that the bullet’s brass casing was made by Global Brass.

The company has international reach with an 80%-owned Chinese joint venture and a 50% stake in a Japanese venture. It serves the U.K., Asia and Germany through distribution agreements.

Global Brass operates with a “balanced book” approach, which reduces the impact of metal price fluctuations on earnings. What this means is the timing, price, and quantity of commodity purchases is matched with sales. This also allows fixed prices and shipment terms to be offered to clients. In addition, Global Brass’ price exposure is mitigated by derivatives and purchases of the physical metal.

Second-quarter results paint a picture of a solid, growing company. Although volume has decreased due to lingering effects of the recession, margins have expanded appreciably. The consolidated adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) came in at 93% higher in 2012 than in 2008 despite the reduction in volume. In addition, net income came in at more than $12 million in 2012, compared with a loss of more than $69 million in 2008.

In this year’s second quarter, Global Brass saw a 7.5% increase in volume and consolidated adjusted EBITDA of over $36 million, up 16% from the same period last year. Earnings per share rose to $0.75, an increase of $0.16. The company credits greater demand in the housing, building, munitions and coinage markets for the improvements.

Getting back to the example of my first copper purchase, it’s important to note that Global Brass is a certified supplier to the U.S. Mint. Legislation called the Currency Optimization, Innovation and National Savings (COINS) Act is being considered by Congress that would replace the dollar bill with a coin.

This change could save the government billions over the long term. In addition, it will provide a tremendous growth opportunity for the company’s Olin Brass segment. This may be what Griffen is betting on to keep this company solidly in the black.

Risks to Consider: As a recent IPO, Global Brass and Copper has not been battle-hardened in the financial markets despite its experience. In addition, wildly gyrating copper prices can only be hedged so far. Be sure to use stop-loss orders and diversify properly when investing.

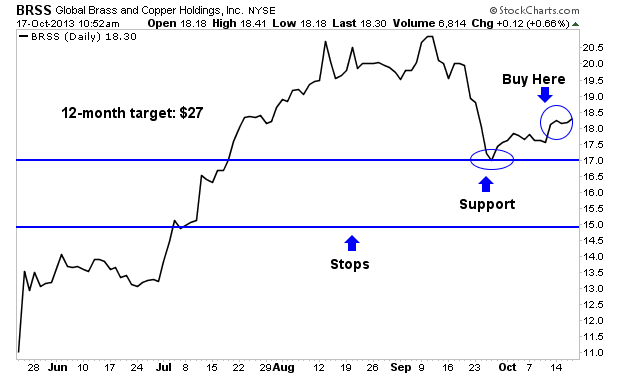

Action to Take –> BRSS has fallen from the highs in the $21 area to find support at $17. Shares have since bounced higher and are in a gentle uptrend higher. There is not enough data to plot a 200-day simple moving average, but the 50-day simple moving average is just above $19. Buying now in the $18 to $18.50 range with a stop at $15 and a 12-month target price of $27 makes solid sense.

P.S. Want to beat the performance of investing gurus like Ken Griffin? With a new system from StreetAuthority’s Michael J. Carr, it’s possible. In his free webinar, Michael shows investors how to leverage the holdings of nearly two dozen legendary investors — including Buffett, Soros and Icahn — to easily beat the market… or even the gurus themselves. For more information and watch this free webinar, click here.