The Best Way To Profit From Surging U.S. Oil Production

If you haven’t heard, America is up to its ears in domestically produced crude oil and natural gas liquids — thanks to the shale boom.

#-ad_banner-#This is good news for supporters of American energy independence. Oil imports have fallen 24.6% since 2006, from a high of 10.1 million barrels a day to 7.6 million barrels a day last year, according to the U.S. Energy Information Administration.

At that pace, the U.S. could become a net oil exporter by 2020.

Unfortunately for upstream oil and gas producers, there aren’t many buyers for all the new crude oil and natural gas liquids (NGLs) coming out of the ground.

The entrenched Gulf of Mexico refineries were engineered decades ago to process heavy, high-sulfur crude oil from Venezuela, Saudi Arabia, Alaska’s North Slope, and the deepwater Gulf of Mexico. These refineries cannot process much of the light, low-sulfur stuff now coming from U.S. shale reservoirs.

Today, there is a glut of crude oil and other liquid hydrocarbons at tank farms in Texas, Oklahoma and other major supply hubs.

One type of liquid hydrocarbons with which U.S. inventories are particularly oversupplied is gas condensate. Condensate is an oil-like substance that morphs from a gas into a liquid when atmospheric pressure drops, as when gas rushes out of the wellhead — or when it flows through a natural gas processing plant.

The basic laws of supply and demand suggest that oil producers would be better off selling lighter crude oils and NGLs to buyers in Europe, Asia and Canada, where refineries are better equipped to handle the light crude blends.

Until last month, federal law prohibited U.S. oil and gas companies from exporting raw crude oil and condensate to foreign markets, The export ban was established after the Arab oil embargo in the 1970s, a time when U.S. domestic oil production was in steep decline.

However, news broke late last month that the U.S. Commerce Department awarded licenses to export condensate to Enterprise Products Partners (NYSE: EPD) and Pioneer Natural Resources (NYSE: PDX). The announcement signals that the Obama administration is preparing to test the controversial waters surrounding the exportation of the U.S.’ homegrown energy resources for the first time in nearly 40 years.

Enterprise is the standard-bearer in the NGL processing and transportation business. It is a master limited partnership (MLP) with a market cap of $69 billion. Its asset base extends into every major U.S. shale basin and includes 51,000 miles of pipelines, 200 million barrels of liquid storage capacity, 24 natural gas processing plants, and 22 NGL fractionators. Its core assets make it a strong competitor to Kinder Morgan (NYSE: KMI) in the large-cap oil and gas transportation segment.

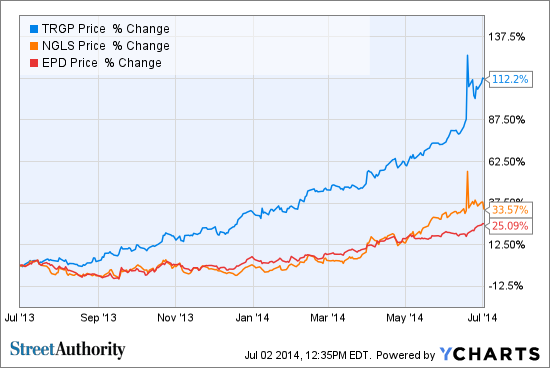

Shares of EPD have gained about 25% over the past year. The company paid out $2.78 per unit in distributions in that time, good for a 3.7% yield. Distributions have grown steadily at 6% a quarter.

However, Targa Resources is perhaps a more compelling option for investors seeking exposure to natural gas liquids. It is a younger, leaner company poised to compete strongly with Enterprise in the NGL space.

Targa actually comprises two public companies: Targa Resource Partners (NYSE: NGLS), a $7.9 billion MLP, and $5.3 billion Targa Resources Corp. (NYSE: TRGP), which acts as the general partner. The MLP owns and operates Targa’s portfolio of assets and pays up to 48% of its distributable cash to the general partner in the form of IDRs (incentive distribution rights).

Targa is building out a network of assets the span the NGL value chain, from gathering and processing to storage and marketing. It operates 11,300 miles of natural gas pipelines, 10 processing plants, railcars, pressurized NGL barges, and other related equipment. The second-largest operator at the NGL hub at Mont Belvieu, Texas, Targa also operates its own export facility at the Galena Park marine terminal near Houston.

Targa is wrapping up a $2.2 billion capital spending program for 2013 and 2014. The program includes $1 billion to expand its upstream gathering and processing system, and $1.1 billion to expand its downstream business segment.

This spending should result in greater NGL throughput capacity in this year’s third quarter. Gas-gathering capacity is expected to expand from 900 million cubic feet (MMcf) a day at the end of 2013 to 1,340 MMcf a day at the end of this year. NGL export capacity is projected to expand from 4 million barrels per month to 6 million barrels over the same time period.

NGLS has gained better than 30% over the past 12 months. The MLP paid $2.95 per unit in distributions over the past four quarters for an average yield of 5.1%. Distributions grew 9.3% over the past four quarters.

Meanwhile, shares of TRGP have climbed more than 110% over the past year. TRGP pays a quarterly dividend of $2.357, representing a dividend yield of 2.4% and up 41% over the past four quarters.

Risks to Consider: IDR fee structures are under the microscope as a result of ongoing organizational challenges at Kinder Morgan, a competitor of both Enterprise and Targa. Further criticism of IDRs could pose challenges for Targa Resources, regardless of the company’s growth opportunities with its NGL processing assets.

Actions to Take –> Buy Targa Resources ahead of its capacity expansion. Investors seeking a long-term tax shelter should buy and hold units of NGLS; short-term investors and IRA investors should purchase shares of TRGP. My three-month price targets are $77 for NGLS (a 7% gain) and $150 for TRGP (a 6% gain).

My colleague Dave Forest just returned from a fact-finding trip to an oil-soaked region that could be the world’s first $1 trillion boomtown. Several oil and mining companies (including one that’s up 1,500% in the past year) are poised to make billions from this under-the-radar hotspot. To get access to some of the stock names and ticker symbols Dave’s recommending, follow this link.