Lock In A 10% Yield With This Rare Monthly Dividend Payer

One of my favorite things about being the Executive Editor here at StreetAuthority is that I get a front-row seat to some of the best financial analysis in the country. I also know from six years of experience in this business that some of our best insight is inspired by you — our subscribers.

#-ad_banner-#We get dozens of emails from readers each and every day. Our paid analysts do a fantastic job of responding to as many of these messages as possible. (Remember, if you have a question or comment on any issue of StreetAuthority Daily, we’d love to hear from you. Send your emails to editorial@StreetAuthority.com.)

Every so often, I see a question come in from a reader — along with a response from one of our chief investment strategists — that’s so good it simply has to be shared with a wider audience.

The question is about the benefits of monthly dividend payers, and Nathan Slaughter, Chief Strategist of High-Yield Investing, was kind enough to respond…

Q. I’m interested in monthly dividend payers. How many stocks pay monthly distributions and can you suggest a good one?

— Mark A., Plano, Texas

A. If there’s one thing better than receiving a dividend every 90 days, it’s getting one every 30 days. There is the immediate gratification of cashing or depositing a check more frequently. But monthly payers offer more than just a psychological benefit — for those who reinvest distributions, they have a real mathematical edge as well.

Compounding your interest 12 times a year rather than 4 might not make a huge difference at first. But over time, it can add up dramatically.

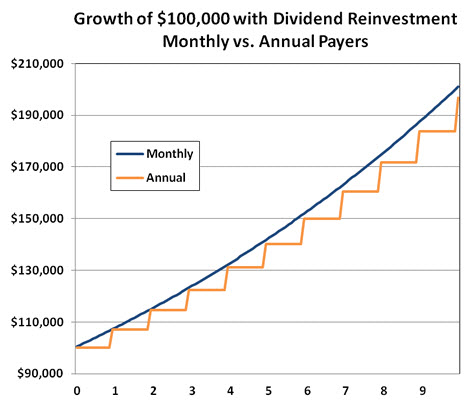

Check out this chart, which illustrates the 10-year growth of two $100,000 portfolios. Both assume a constant 7% yield and are otherwise identical, except one pays dividends and interest monthly and the second annually.

Incidentally, this chart was put together by my colleague Amy Calistri of The Daily Paycheck, one of the staunchest advocates of monthly dividends I know.

Collecting 12 monthly payments of 58.33 cents might not seem much different than one payment of $7.00. But over the next ten years, it can put an extra $4,251 in your pocket.

That is essentially free money that doesn’t require any commensurate increase in risk. But you can thank the monthly payment schedule for enough cash to take a nice European cruise.

In my database, I count more than 700 securities that dish out monthly distributions. The overwhelming majority of those are ETFs and closed-end funds. The pool of common stocks is much shallower. But there are a few dozen to choose from, including a couple names you might already be familiar with, such as current High-Yield Investing portfolio holdings Realty Income (NYSE: O) and Prospect Capital (Nasdaq: PSEC).

Another one you might want to consider is Linn Energy (Nasdaq: LINE), a rare upstream master limited partnership (MLP). Much like one of my current holdings, Linn acquires mature oil and gas-bearing properties and then uses hedge contracts to stabilize pricing and immunize cash flows against commodity price volatility.

The company was attacked last year by a dubious short selling firm that questioned the Linn’s accounting practices (among other complaints, alleging improperly calculated distributable cash flows). The bearish arguments spooked investors, almost cutting the stock price in half.

But a subsequent investigation by the SEC revealed no wrongdoing, and the shares have since stabilized. But they still don’t adequately reflect the earnings potential of the firm’s assets, particularly after the accretive $4.6 billion acquisition of Berry Petroleum in December 2013.

With 22,000 producing wells from Texas to North Dakota, Linn’s oil and gas output now exceeds 1 billion cubic feet equivalent per day. And these long-lived properties hold 7 trillion cubic feet of reserves, which will provide a steady, predictable cash flow stream well into the future.

The shares have historically offered a robust 8.2% dividend yield over the past four years. But the recent dip has allowed investors a chance to lock in a 10% yield — almost double the MLP average. And it comes in the form of 12 monthly payments of $0.242 per year, for an annual dividend of $2.90.

I don’t have the space for a complete analysis today, but LINN will definitely be on my radar and should be on yours as well.

P.S. — When you think about all of the Baby Boomers who are looking for a way to pay their monthly bills, it’s no surprise that the number of monthly dividend-paying securities is also growing. That’s one of the reasons why my colleague Amy Calistri covered two unique investments that pay monthly dividends in a recent issue of her premium newsletter, The Daily Paycheck. In fact, Amy’s strategy has been so successful that she was recently invited to speak about it in front of a live audience at St. Edward’s University. To get access to the filmed presentation and the names and ticker symbols of a few of her favorite high-yield stocks — I invite you to watch the filmed presentation here.