The Perfect Setup: A Win-Win Trade On A High-Yield Stock

Market volatility has increased, and that is likely to be a recurring theme in the market for at least the next few weeks. Actually, I believe volatility will remain elevated for some time. That’s because the current level of volatility isn’t unsustainable…

| —Sponsored Link— |

| Startup Founder Predicts What’s Next For America He’s invested in 1,000 companies and set stock market records. Today, he begins a controversial project that every American investor should see. Click here to read more. |

In fact, it’s not even really that high. It’s simply higher than it was in the recent past.

We enjoyed low volatility throughout 2017, so after a year of such calm waters, a little market movement is normal. In fact, it’s the recent calm we experienced throughout 2017 that was abnormal.

#-ad_banner-#While volatility can coincide with price declines, as it has in the past two months, volatility can also create trading opportunities.

The High-Yield Market You Can’t Ignore

Recent volatility has created an opportunity in an entire sector — Master Limited Partnerships (MLPs). If you’re not familiar with MLPs, don’t worry! They’re securities that trade just like stocks, but they have a certain tax advantage that helps boost their yields.

While most publicly traded companies pay taxes on their earnings, MLPs are known as “pass-through entities” because they pass the majority of their earnings on to their investors in the form of large income distributions. This special setup allows the companies to avoid paying taxes (although their investors still have to). But because of noncash charges and accounting rules, the tax liability has historically been lower for the individual.

Just how much income do these MLPs tend to pay out? Well, one ETF that tracks the MLP sector — Alerian MLP ETF (NYSE: AMLP) — has a yield of more than 8%.

Not too shabby, considering that the average stock on the S&P 500 yields less than 2%.

But recently, the sector received some bad news and traders sold, creating our latest buying opportunity. You can see the impact of the selloff on AMLP’s price chart below.

The large down day occurred on March 15 after the Federal Energy Regulatory Commission (FERC) ruled that MLPs will no longer be allowed to recover an income tax allowance that was previously available to interstate natural gas and oil pipeline operators.

The FERC noted that MLPs previously “were able to receive an income tax allowance to compensate for investors’ taxes on the partnership’s income.” But because MLPs don’t pay income taxes, the allowance wasn’t justified.

This news sent the sector lower even though only some MLPs will be affected by the ruling. FactSet, a research firm, noted that the selloff created a buying opportunity in the sector.

According to The Wall Street Journal,

“The biggest factor driving future returns is valuation, and the regulatory ruling succeeded in pushing MLPs to a level that has sparked past rallies. As of Friday, the index was trading at an 8% discount to the S&P 500 on the basis of price to projected funds from operations over the following year, according to FactSet.

The only two occasions in the past decade that saw a similar discount, in November 2008 and February 2016, preceded rallies of 50% and 60% respectively in the index over the following six months.“

Our Best Shot At Easy Income

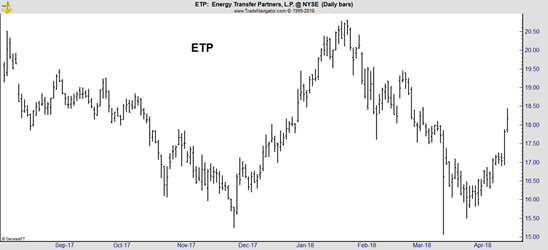

While the entire sector could be a “buy,” Energy Transfer Partners LP (NYSE: ETP) is of particular interest. The chart below shows the shares fell sharply when the FERC ruling was released and continued drifting lower before starting to recover.

ETP issued a statement saying the new rules “are not expected to have a material impact to ETP’s earnings and cash flow.”

The partnership explained:

“Many of ETP’s rates are set pursuant to negotiated rate arrangements or rate settlements that it believes would not be subject to adjustment, or would be limited in terms of adjustment. In addition, many of its current transportation services are provided at discounted rates that are below maximum tariff rates, many of which it believes would not be impacted by a change in the maximum tariff rate.“

ETP owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with operations covering logistics and transportation platforms for natural gas, natural gas liquids, crude oil and refined products.

Among other assets, the partnership controls more than 71,000 miles of natural gas and oil pipelines spanning the country, as well as more than 60 facilities for processing, treating and storing its various energy products.

As an MLP, ETP’s most important financial metric is cash flow from operations (CFO), which is used to fund its distributions to shareholders. When distributions exceeded cash flow in 2016, ETP cut its payout. However, the recent recovery in CFO means the payout could be raised. The next distribution of at least $0.565 per share is due in early May.

Given the low valuation of the sector, the fact that the recent selloff is most likely an overreaction to news, and the high income available from ETP, I think this MLP is prime for an income trade — especially with the strategy my subscribers and I use over at Maximum Income.

The Market’s Only Win-Win Move

While revealing the specifics of this ETP trade here wouldn’t be fair to my paying subscribers, I can tell you what we stand to gain.

Come June, if ETP is still trading below our “strike price,” like it is now, we pocket a 4.8% gain (that’s 30.6% annualized by the way). But if it isn’t, we’re in even better shape, nearly doubling our return to 9% (57.5% annualized).

The secret to all of this is covered call options. If this sounds too complicated, let this free report change your mind.

In simple terms, my strategy helps you collect extra income from some of the best stocks on the market — practically in an instant. The payments start arriving within a day or two of making the trade… and are often much bigger than a dividend payment. Best of all, you can still collect your regular dividends — and pocket any gains the stock makes along the way.

And you can repeat these trades again and again throughout the year to earn even more income.

If that sounds good to you, you can follow this link to learn more.