Two More Predictions for 2024: Crypto ETFs and a Nuclear Breakthrough

We’re now entering the final stretch in the race to Christmas. It’s time to wrap the presents and put them under the tree.

It’s also nearly time to put the bow on 2023. As we wrap up this roller coaster of a year, I’m sharing my forecast for the next one in Street Authority Insider.

From now until New Year’s each issue will contain two of my predictions for 2024.

Remember, that not all of these ideas may not materialize in the coming 12 months. That’s all part of investing.

However, it doesn’t take many game-changers to put you on the path to financial independence.

Have a wonderful holiday weekend!

Modular Nuclear Reactors Will Make a Commercial Breakthrough

I was invited to an energy conference recently where the keynote address was given by none other than Rick Perry, the three-term Texas governor and former Department of Energy secretary under President Trump.

Perry had some fascinating tales about holding a cabinet position and even teased inside gossip about Nevada’s controversial Area 51 (which is supposedly under the purview of the Energy Dept.).

But I found his comments on nuclear energy to be the most insightful. As you might guess, he’s a fully supportive fan of nuclear as part of a comprehensive package.

Texas has just two nuclear power plants, but they supply about 40 million megawatt hours of clean energy per year, powering roughly one in 10 homes and businesses across the state.

Nationwide, nuclear energy accounts for nearly 20% of the power grid — about the same as wind, solar, and hydro sources combined.

Nuclear reactors provide emission-free baseload electricity that can be counted on during severe winter storms or sweltering summer heat waves when homeowners crank up the thermostat and create a bigger burden for already-overloaded local utility providers.

And in the wake of Russia’s Ukraine invasion and the subsequent weaponization of energy supplies across Western Europe, nuclear energy is enjoying a renaissance around the globe.

Chile, Saudi Arabia, and two dozen other countries now have nuclear power programs in various stages.

Even Japan has pivoted away from earlier plans to displace nuclear energy by the end of the decade. Officials have reversed course and are now committed (with enhanced safety protocols) to tripling nuclear’s share of the country’s power mix.

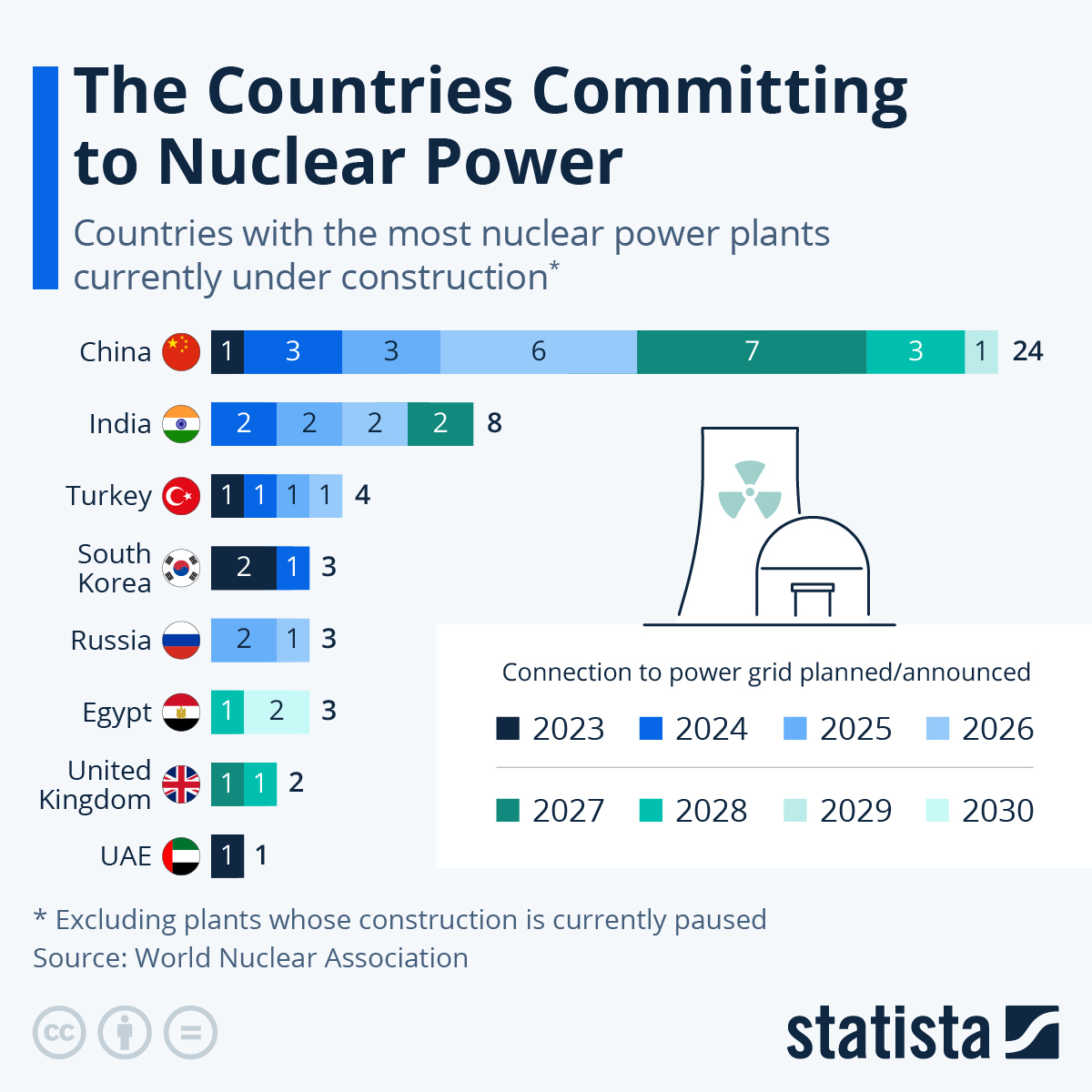

Source: Statista

Source: Statista

Here in the United States, Georgia’s Vogtle 3 went into service earlier in 2023. Backed by billions in tax credits and loan guarantees from the Department of Energy, Vogtle 3 and its sister unit, Vogtle 4, have the capacity to provide electricity to more than 1 million homes and businesses.

Still, there’s a reason why this is the first large-scale nuclear facility to be built in 30 years. Permitting hassles aside, the Vogtle project took 14 years to complete and cost about $30 billion from start to finish.

That’s why policymakers (and investors) are so excited about the development of small modular reactors (SMRs). For starters, they are just a fraction of the size of conventional plants. In fact, they can be pre-fabricated in a factory and then shipped where needed for quick on-site assembly and certification.

While lacking the yield of full-size plants, these microreactors provide plenty of bang for the buck. And with a tiny footprint, they can be positioned almost anywhere. Close to remote rural communities with limited capacity and infrastructure. On top of decommissioned coal plants.

That makes SMRs easier to connect to the local grid transmission lines, potentially saving hundreds of millions of dollars. Better still, these smaller units need to be refueled only every three to seven years.

While competing technologies are still being developed, SMRs could be a cost-effective and carbon-free solution to meeting our future power needs. They are already under construction from Canada to China.

One pioneer has a valuable first-mover advantage in this groundbreaking field. As you might expect, the Nuclear Regulatory Commission (NRC) has exceedingly high standards for structural integrity and safety. And NuScale Power (NYSE: SMR) has met them with flying colors.

The ticker symbol says it all. Channeling $1.6 billion into its R&D (research and development) budget, NuScale is the first U.S. manufacturer to gain regulatory a c E2P&fYHmpproval for its SMR designs. The company has all but eliminated safety concerns, developing a passive system that will shut down and self-cool in an emergency, even without water.

The stock took a hit recently after a project cancellation. But this setback is only a speed bump. SMRs could account for one-third of all nuclear power installations going forward. This is forecast to be a $18 billion industry by 2030 — and with 686 patents, NuScale has the inside track.

Wall Street has a consensus $10 price target on the stock, implying a potential 200% upside from here.

Those interested in this sector may also want to keep an eye on Denison Mines (NYSE: DNN). Nuclear reactors have an insatiable appetite for fuel. And this Toronto-based company is involved with several world-class uranium projects north of the border.

Denison Mines provides fee-based milling and refining operations just up the road from McArthur River (one of the world’s richest sites). But the jewel in the crown is its 95% ownership in the flagship Wheeler River Project.

Located in the heart of the Athabasca Basin mining belt in Saskatchewan, this is one of the world’s largest untapped uranium deposits. Years of geologic studies and test drilling have revealed a treasure trove of 109 million pounds of probable reserves in place.

DNN is positioned to become North America’s next large-scale uranium producer and is a hot takeover target as well.

The SEC Will Approve the First Bitcoin ETF

Don’t look now, but as I write, Bitcoin (BTC) has surged above $43,500. Cryptocurrency investors are relishing a powerful 160% advance over the past 12 months.

That gain reflects increasing odds that regulators will approve a spot Bitcoin ETF in the coming year. And if that’s what happens on mere speculation and rumor, then imagine the frenzy once the Securities and Exchange Commission (SEC) actually gives the green light.

The big crypto players have been trying to get this done since 2013, but the SEC has stubbornly resisted.

However, Wall Street giants like BlackRock (NYSE: BLK), Fidelity, and Franklin Templeton (NYSE: BEN) are lining up in support. And with the Department of Justice settling its despite with Binance, the last major hurdle may have been overcome.

There is a growing consensus forming that the thumbs-up could be given within the next three to six months.

The word “Bitcoin” appeared in 1,074 corporate filings in November, reflecting increased interest on Wall Street. As we speak, no fewer than a dozen Bitcoin ETFs are pending. Bloomberg analysts predict a 90%-plus chance that these applications could get approved in early 2024.

An ETF would provide a safe, low-cost way for investors to participate in Bitcoin without the hassles of buying and safely storing the digital coins.

This could open up the crypto market to a whole new universe of interested buyers.

Remember when Bitcoin rose 10-fold in 2017? I’m not suggesting a repeat here. But prices around $100,000 aren’t out of the question.

Keep in mind that sovereign nations such as Argentina have proposed the adoption of Bitcoin to protect citizens from reckless central bank policies that devalue local currencies.

Even if you’re not on board with the idea of holding cryptocurrency, there is a brick-and-mortar back door into this virtual world. One with tangible assets — and profits.

I’m referring to a company that has built a Bitcoin mining facility in Texas. Harnessing massive computer power, this miner validates global blockchain transactions, earning a steady stream of Bitcoin as compensation.

Consider a small stake in Riot Platforms (NSDQ: RIOT). On average, the company is producing about 18 Bitcoin per day — 552 for the month of November. The company now holds more than 7,000 coins, selling 540 last month and raking in proceeds of nearly $20 million. For context, that’s a 140% increase from a year ago.

Source: Riot Platforms

If a Bitcoin ETF is approved (and prices respond as we expect), few companies will more directly benefit than Riot. We see the stock ascending to a new high above $20 next year.

I also see tailwinds on the horizon for Wisdomtree (NYSE: WT).

While best known for its unique lineup of dividend-weighted index funds, the company — which has $80 billion in assets under management — has made aggressive inroads into blockchain technology, cryptocurrency, and the conversion of physical property into digital tokenized assets.

Wondering how to be best positioned as cryptocurrencies experience a renaissance?

Our team thinks a select few cryptos are about to go on another monster run — and we just released a bombshell briefing about how you can profit.