Musk’s Delaware Debacle, Boeing’s Q4, and Food Prices

Editor’s Note: TGIF, dear reader! This week seemed short and sweet. I hope you have a good weekend planned!

Elon Has a Bad Day in Delaware

Elon Musk — the Tesla (NSDQ: TSLA) CEO you either love or hate — had a bad day this week thanks to a Delaware Chancery Court

That’s because a court judge threw out Musk’s $56 billion 2018 pay package.

According to Delaware Chancery Court Chancellor Kathaleen McCormick, Musk and Tesla’s board of directors “bore the burden of proving that the compensation plan was fair, and they failed to meet their burden.”

The plaintiffs — Tesla shareholders — claimed that the electric vehicle (EV) maker’s board members are too close to Musk to be independent. Board members include Musk’s brother, his divorce lawyer, and an old family friend.

Over the years, the board has allowed Musk to make several questionable moves — including the purchase of SolarCity Corp. for $2.6 billion in 2016.

In addition, the plaintiffs in this case argued that Tesla misled shareholders who voted in favor of Musk’s $51 billion pay package in 2018.

That’s because Tesla informed shareholders that the company would have to hit certain financial targets for Musk to qualify for the payday. However, as the plaintiffs argued, these targets were not “stretch performance goals,” but the company’s own internal growth forecasts.

“We are enormously grateful for the court’s thorough and extraordinarily well-reasoned decision in turning back the Tesla board’s absurdly outsized pay package for Musk,” a statement from one of the plaintiff’s attorneys said.

Of course, Tesla’s attorneys argued that the pay package benefited shareholders by helping to boost the value of the electric vehicle (EV) maker’s shares. They pointed out that Tesla’s market cap soared more than 1,000% since the pay package was approved, from $54 billion to $607 billion.

However, in her decision, McCormick wrote, “Musk launched a self-driving process, recalibrating the speed and direction along the way as he saw fit.”

“Given the collection of people tasked with negotiating on Tesla’s behalf, it is unsurprising that there was no meaningful negotiation over any of the terms of the plan.”

Musk can always appeal the case with the Delaware Supreme Court. However, he’s already taken to X to ask shareholders to vote to reincorporate the company in Texas.

I’m Starting to Feel Kind of Sorry for Boeing…

Boeing (NYSE: BA) reported fourth-quarter results this week that beat Wall Street’s expectations. However, due to all the troubles involving the company’s 737 Max 9 jets and quality control, the airplane maker decided to forgo providing a full-year forecast.

The company reported revenue of $22.02 billion, versus Wall Street estimates of $21.07 billion. The quarter’s commercial sales totaled $10.48 billion versus an expected $10.04 billion.

The company also reported a narrower-than-expected adjusted loss of 47 cents per share, versus a loss of 76 cents per share.

Boeing also grew its core operating margin, coming in at 0.4% versus last year’s negative 3.2%.

However, Boeing’s current quarter and full year are looking murky, thanks to the Max 9 debacle.

“While we often use this time of year to share or update our financial and operational objectives, now is not the time for that,” CEO Dave Calhoun said this week.

“We will simply focus on every next airplane while doing everything possible to support our customers, follow the lead of our regulator, and ensure the highest standard of safety and quality in all that we do.

“Ultimately, that is what will drive our performance.”

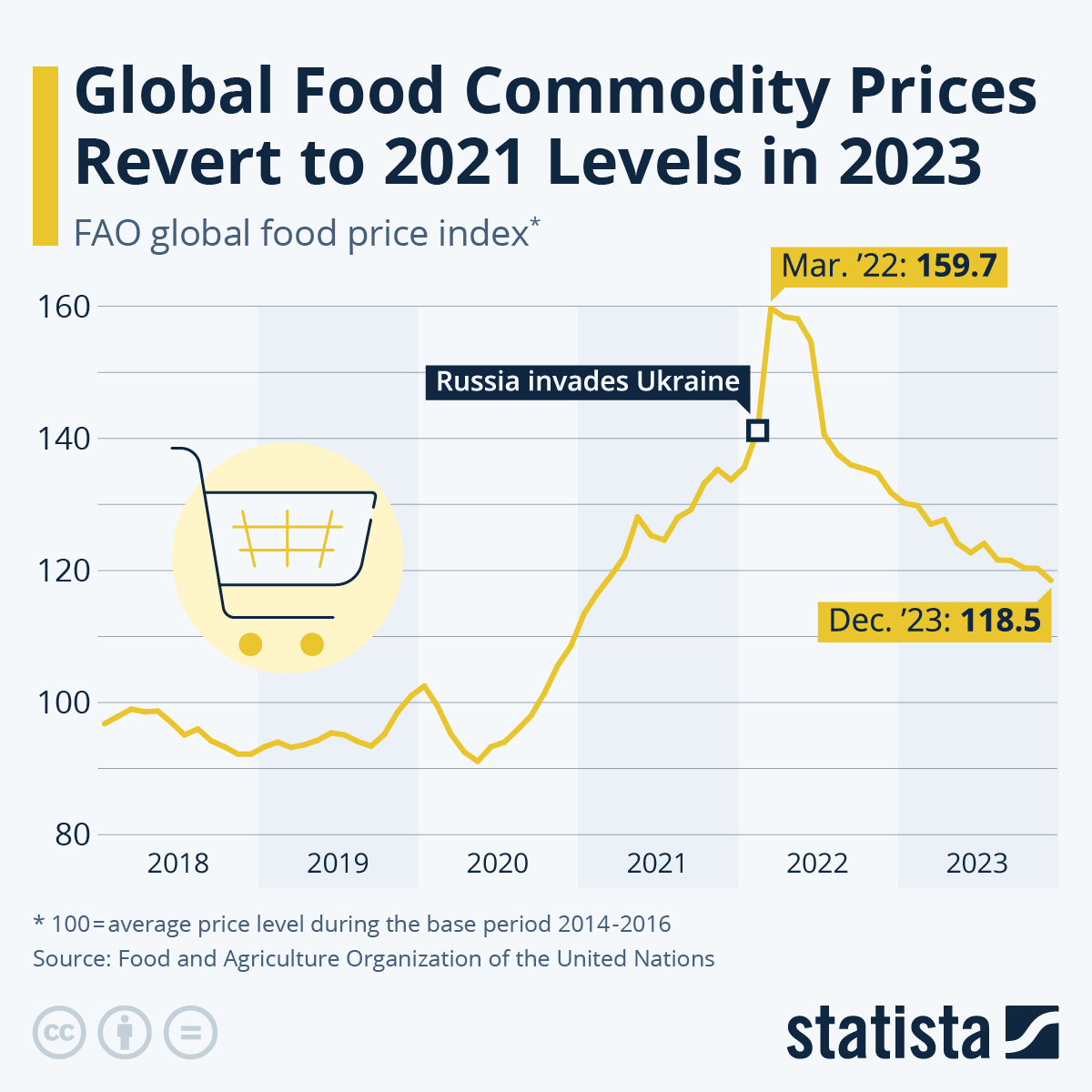

Food Commodity Prices Are Falling

According to the UN’s Food and Agriculture Organization (FAO), food commodity prices have fallen back to 2021 levels.

The FAO’s Food Price Index reached record highs in 2022 due to a combination of pandemic recovery effects and the Russian invasion of Ukraine.

In March 2022, the index reached a record high of nearly 160 points.

But by December 2023, the index had retreated to 118.5 points. However, food commodity prices remain significantly higher than pre-COVID pandemic levels.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

Is Another Banking Crisis in the Works?

Shares of American regional banks took a tumble this week after New York Community Bancorp (NYSE: NYCB).

It looks like investors are worried that we’re in for a repeat of last year’s regional banking crisis.

On Wednesday, NYCB reported an unexpected loss of $252 million in the fourth quarter — versus a profit of $172 million in the year-ago quarter.

The lender also reported that its losses on loans rose from $62 million in the third quarter to $552 million in the fourth.

NYCB also spooked investors by announcing that it would cut its dividend by 70%.

Shares of NYCB plummeted by a record 37.6% on Wednesday. They lost at least another 10% on Thursday.

Although analysts have argued that the bank’s problems are specific to NYCB, the news dragged down shares of other regional banks — including Alliance Bancorp (NYSE: WAL) and Valley National Bancorp (NSDQ: VLY).

“We believe NYCB has several idiosyncratic characteristics, but the result and reaction are reminders of risks that remain in the regional banking space,” analysts at Jeffries wrote in a note to clients.

Meanwhile, Interactive Brokers Chief Strategic Steve Sosnick said,” Many traders believe that warnings of the type we saw from NYCB are like cockroaches — if you see one, there must be more hiding just out of sight.”

P.S. If you’re looking for promising profit-making opportunities, consider the work of my colleague, Nathan Slaughter, the chief investment strategist of High-Yield Investing.

For the last 16 years, Nathan has made it his solitary focus to help everyday Americans invest profitably for retirement.

As a high-yield expert, Nathan has devised a simple strategy that could help you generate a steady stream of cash, almost like clockwork. Click here for details.