Amazon Will Join the Dow, Nvidia’s Killer Q4, and CapitalOne Makes a Play for Discover

Editor’s Note: Happy Friday, dear reader! Here’s your obligatory TGIF meme:

Now let’s get to it!

Amazon Will Join the DJIA

It’s telling that S&P Dow Jones Indices, which manages the Dow Jones Industrial Average (DJIA), has decided to kick Walgreens Boots Alliance (NSDQ: WBA) off its list and replace it with Amazon (NSDQ: AMZN)

According to a statement from Dow Jones, the update will “[reflect] the evolving nature of the American economy.”

In other words, e-commerce, cloud computing, and artificial intelligence (AI) are in. Drugstores are out.

When Amazon joins the Dow 30 on Monday, it will become the third “Magnificent Seven” stock on the list.

The Magnificent Seven replaces the old acronyms of FAANG, GAFAM, etc., which represented groups of Big Tech stocks in previous eras of enthusiasm.

The Magnificent Seven, which collectively enjoyed an average gain of 111% in 2023, includes Amazon, as well as current DJIA members Apple (NSDQ: AAPL) and Microsoft (NSDQ: MSFT), along with Google parent Alphabet (NSDQ: GOOGL), Meta Platforms (NSDQ: META), Nvidia (NSDQ: NVDA), and Tesla (NSDQ: TSLA).

Of the seven, Tesla is currently the laggard, having lost roughly 22% of its value since the start of the year.

Anyway, it’s no big surprise that Walgreens is getting booted from the list. The pharmacy chain is the cheapest stock on the DJIA — currently priced around $22. For comparison, the next-smallest stock on the list is Verizon (NSDQ: VZ), which is worth nearly twice as much, at roughly $41 per share.

Currently, UnitedHealth Group (NYSE: UNH), which trades for more than $522 per share, is the most expensive stock on the Dow.

Amazon, which is currently worth around $174 per share, is a better fit for the group, price-wise. That’s because the Dow is weighted by share prices — unlike the S&P 500, which is weighted by market caps.

Nvidia Reports a Killer Q4

Nvidia (NSDQ: NVDA) announced fourth-quarter earnings this week that exceeded Wall Street’s already-high expectations.

The U.S.-based chip designer reported that revenue reached $22.10 billion for the quarter. That’s a year-over-year increase of 265%.

In addition, profits surged by an incredible 769% year over year as the company benefited from last year’s artificial intelligence (AI) buzz. For the year-ago quarter, Nvidia reported net income of $1.4 billion. This time, it reached nearly $12.3 billion.

As a whole, Nvidia’s full-year profits rose 580% on a year-over-year basis.

That’s because Nvidia-designed chips are a critical component of many AI training models. The company counts Meta Platforms (NSDQ: META) — the company formerly known as Facebook — and Microsoft (NSDQ: MSFT) — currently the most valuable publicly traded company in the U.S. — among its biggest customers.

In addition, Nvidia issued guidance for the current quarter that indicated it’s expecting revenue to total $24 billion. If so, Nvidia would continue to beat the pants of the analyst consensus.

“Fundamentally, the conditions are excellent for continued growth,” CEO Jensen Huang said on an analyst call Wednesday. And as he stated in a statement, “Demand is surging worldwide across companies, industries, and nations.”

Once known primarily for its computer hardware favored by serious video game players, Nvidia’s AI processors have made the company a household name. The company’s products currently comprise about 70% of AI semiconductor chip sales.

It certainly hasn’t hurt that in the last 12 months, the company’s stock has soared by more than 225%. In fact, Nvidia was the top-performing stock on the S&P 500 in 2023.

According to the fourth-quarter report, Nvidia’s Data Center unit saw sales of $18.4 billion. That’s a 409% increase on a year-over-year basis. This unit includes the graphics cards that companies use for AI training.

Reddit Preps for Its IPO

Social media company Reddit may take a cue from Robinhood (NSDQ: HOOD) and award some of its most prolific users the chance to profit when the company holds its initial public offering (IPO) next month.

According to a report from The Wall Street Journal, Reddit plans to give roughly 75,000 of its users — or “Redditors” — the chance to buy shares at the IPO price before public trading begins. Typically, companies offer first dibs to institutional investors with billions of bucks to spend, rather than individuals.

However, the plan may backfire, as it did for Robinhood when the trading platform IPO’d back in 2021.

Because individual investors are more likely to quickly sell shares rather than hold on like institutional investors, that made HOOD’s first day on the Nasdaq more volatile than usual.

According to Bloomberg, Reddit is targeting an IPO valuation of $5 billion. That’s half the $10 billion valuation the San Francisco-based company received during a funding round in 2021.

What’s in Capital One’s Wallet?

This week, Capital One (NYSE: COF) announced that it plans to acquire rival credit card company Discover Financial (NYSE: DFS) for $35.3 billion.

If the deal goes through, it will turn Capital One into the world’s largest credit card company by loan amount — bypassing current reigning champ JPMorgan Chase (NSDQ: JPM).

It will also add $109 billion in total deposits from Discover’s banking operations to Capital One’s coffers.

However, according to Capital One CEO Richard Fairbank, one of the biggest reasons for the acquisition lies in Discover’s payments network. This network facilitates electronic transfers between merchants and customers — taking a percentage along the way.

“That network is a very, very rare asset,” Fairbank said on a call with analysts. “We have always had a belief that the Holy Grail is to be able to be an issuer with one’s own network so that one can deal directly with merchants.”

There are only four card companies with this type of network: Discover, Visa (NYSE: V), Mastercard (NYSE: MA), and American Express (NYSE: AXP). Currently, Discover is the smallest player on this shortlist.

Fairbank said that he plans to boost Discover by switching all of its debit card volume to its network. Last year, Discover facilitated $550 billion in transactions.

The goal is for Capital One to add a minimum of $175 billion in payments to the Discover network by 2027.

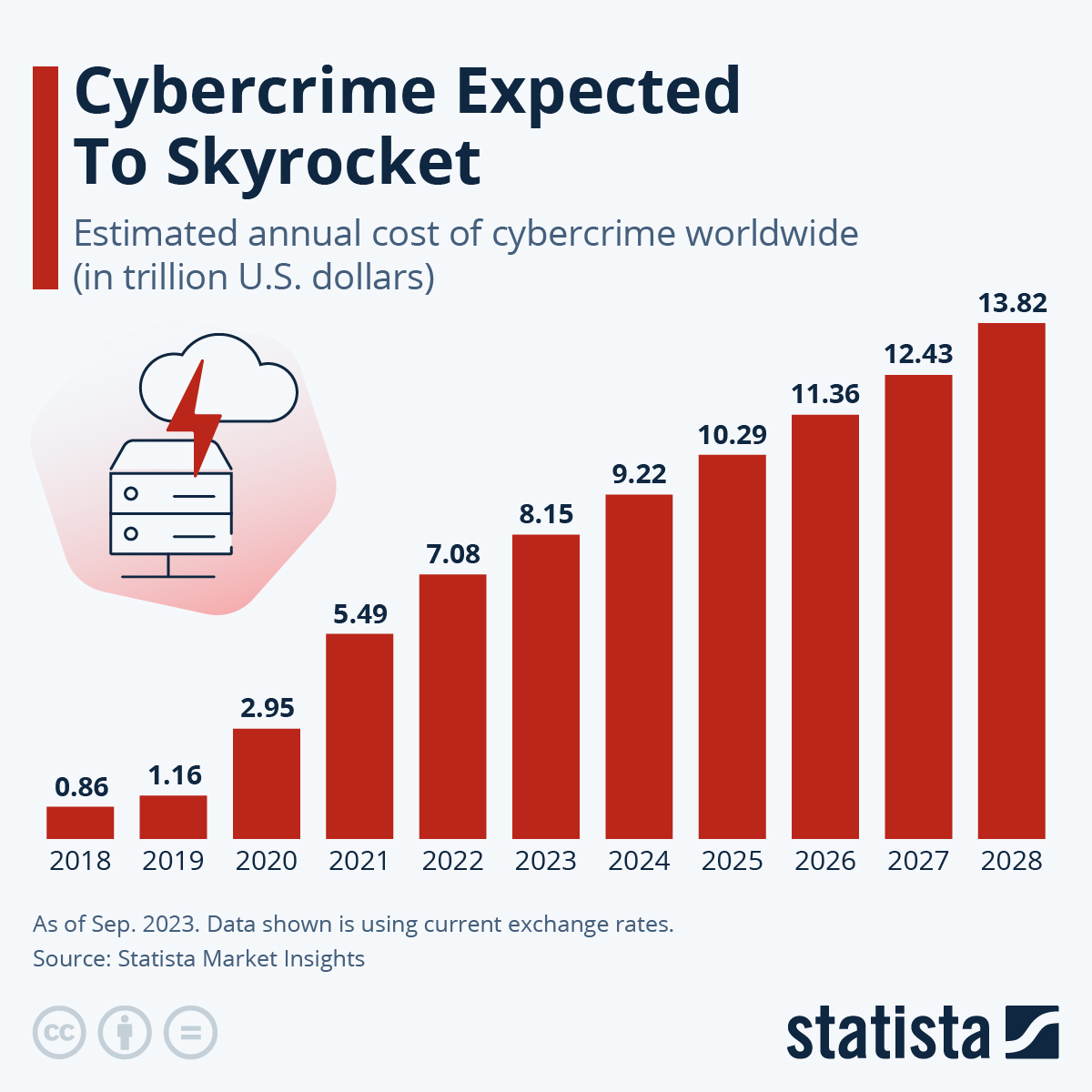

The High Cost of Cybercrime

According to a new Statista Market Insights report, the global cost of cybercrime is expected to grow from $9.22 trillion in 2024 to $13.82 trillion by 2028.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

P.S. Cryptocurrency represents a lasting revolution in finance, investing, and consumer behavior.

Consider this: Bitcoin (BTC), the leading “blue chip” cryptocurrency, gained a whopping 156% in price in 2023.

This bullishness has extended throughout the crypto segment and the momentum is likely to continue throughout 2024.

Every portfolio should have some sort of exposure to crypto. But you need to be informed to make the right choices. Start receiving our FREE e-letter, Crypto Investing Daily. Click here now!